Julie Duteau noticed something strange on her last two phone bills: a surprise $10 fee for a “modem lease.”

Problem is, she already owns her modem.

“I wanted to speak to someone about my bill, but they couldn’t help me,” she says. “I’ve sent emails to the company but received no response.”

That’s always how it starts: the inexplicable fee, the radio silence.

But Duteau’s case is about more — much more — than a few errant fees. It turns out her phone company had been charging her extra for a long time, a total amount that shocked even this veteran consumer advocate.

And it raises a broader set of question about phone bills:

- Can you get a refund for old errors on your phone bill?

- What should you do if you find a surprise charge on your phone bill?

- Will the government finally ban junk fees on your phone bill?

But first things first. I’ll need to advocate this case to get to the bottom of Duteau’s problem. You’ll also want to scroll down to take the poll about who is to blame for this situation. So let’s get started.

What’s this modem lease fee on my phone bill?

Duteau contacted our advocacy team recently because she had a “bit of a problem” with her CenturyLink bill. Actually, it was on her Lumen bill — CenturyLink changed its name to Lumen back in 2020.

“On my last two bills, I’ve noticed charges for a modem lease of $10 monthly,” she says. “When I had my higher speed internet installed in my home, I paid for the modem. So there should have been no lease charges.”

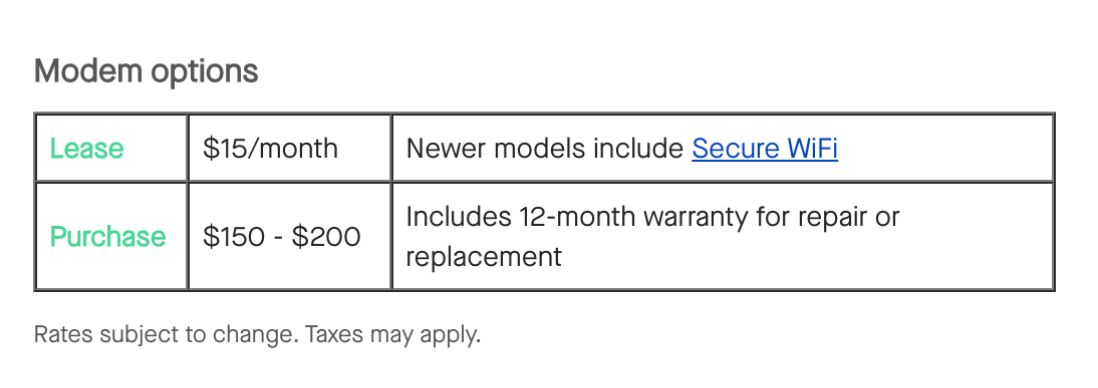

Lumen charges $15 monthly to “lease” one of its high-speed modems. If you want to buy a modem from Lumen, it’ll cost you between $150 and $200.

The lease is not a good deal. You can find a perfectly adequate high-speed modem for less than $100 online. If you lease a high-speed modem for several years, you pay for the same equipment several times. (And wait until you see how much Duteau paid.)

Further complicating her case: Duteau had recently moved to an area not serviced by Lumen. So she canceled her account. That left her with almost no leverage. And she needed all the leverage she could get.

She called Lumen to get more information. Her first question was: “How long has this been going on?”

I haven’t looked back at my bills from last year, but the lady, Rose Marie, who I spoke with, said they go back several months.

When I asked her about a credit for these charges, she stated that I had 90 days to report this, and since I didn’t do that, I can only get back a portion of these charges.

I had no idea they were added on, or why. I just noticed them on my last two bills.

Oh, this is not good. We’re not just talking about $20 here, but potentially much more. When a phone agent says “several” months, it’s time to go back and check your old bills.

“This doesn’t make sense to me,” Duteau says. “I’ve been a loyal customer, paid my bills on time, and had no idea a company would do this to customers.”

Can you get a refund for older errors on your phone bill?

Rose Marie, the call center agent, was right. Most companies give you 90 days — and some of them less — to report a billing error. After that, they keep your money.

Oddly, it doesn’t work the other way around. But regardless of when a company discovers that it underbilled you, it will come after you and also may charge you interest. (Related: Help! BG&E won’t refund my monthly service fee.)

Curiously, Lumen doesn’t even mention the possibility of an overcharge on its payment troubleshooting page.

There’s almost no information available on these internal billing error policies. But in my experience as a consumer advocate, they are pretty rigid. Companies want to make sure the money is theirs to keep, so they give their customers a limited amount of time to flag a billing error.

I learned that the hard way when my son signed up for a resume service through BLD a few years ago. They charged us $24.95 per month for many months before I discovered the problem. BLD would only go back three billing cycles “as a courtesy” to me. How nice of them!

But for phone bills, that’s particularly unfair to customers. Phone companies are masters of hiding their fees in the fine print or in plain view (like cigarette cartons).

“I’m wondering how a company can arbitrarily add charges for leased equipment, and I am expected to notice it myself,” Duteau told me. “Am I out of luck for getting my money back?”

How to find a surprise fee on your phone bill

Internet and phone companies are experts at hiding junk fees in their bills. But there are ways to spot them.

Official-looking fees

Phone companies often express extra fees as if they are official or required by the government. The word “service” is a red flag — a service charge or service fee is always suspect. Also, unbundling the fees can be a sign of trouble. So, for example, “voice mail” or “calling plan” can be a junk fee or even a fee imposed by a third party.

Vague charges

If you see a monthly charge, monthly fee or a minimum monthly usage fee — or anything similar — you may be looking at a nonsense charge. These vague fees could be legit, but more often than not, they are bogus charges on your bill.

Unrecognized fees

These are the easiest ones to spot. They are for services or products you didn’t authorize, like cell phone wallpaper, ringtones, premium text messages about sports scores, or celebrity gossip. And, yes, Duteau’s modem lease fee was right there.

Phone companies know that hiding these fees in plain sight works. They’ve seen tobacco companies post graphic warnings on cigarette cartons without affecting smoking behavior. If it works for them, why can’t it work for phone companies?

What to do if you find a surprise charge on your phone bill

The best way to avoid a surprise charge on your phone bill is to read your bill every month. That’s right, every month.

Why? Phone companies like to add charges to your bill when you’re not looking.

Make sure you understand every charge. For example, do you recognize the names of the charges on your bill? Do you know what you’re paying for? Do you see any unauthorized calls? And maybe most importantly — and easy to miss — did you pay the rate the company quoted you for all of your services?

Contact the phone company in writing

This may be difficult since phone companies love to talk, but you can initiate a chat or send an email through the form on the company’s site. You know the saying: Talk is cheap. If you review the items on your bill by phone, then there’s no proof of the conversation (unless you record the call, which may not be legal in your country or state).

If your phone company can’t help, contact the third party on the bill

Phone companies will allow third parties that provide services to bill you via your monthly phone bill. You can also reach out to those third parties to discuss any questionable charges.

Appeal to an executive

We list the names, numbers and email addresses of phone company executives on this site. Remember to use our strategies for fixing any consumer problem. In other words, make your polite appeal only after going through the first two steps, and always do it in writing.

Complain to the FCC

The Federal Communications Commission may be able to help with your phone bill complaint. You can submit a complaint through its site. The agency may investigate your complaint.

Ask our team for help

Of course, our consumer advocacy team would be happy to help you if you’ve reached the end of your rope. Here’s how to file a complaint.

Duteau had not read her phone bill every month, and she had reached the end of the road on her complaint. So she came to us for help.

She was about to get a big surprise — and so was my team

Will the government ever ban junk fees on your phone bill?

The government has heard thousands of stories like Duteau’s, thanks to the FCC’s complaints line, and it is finally doing something.

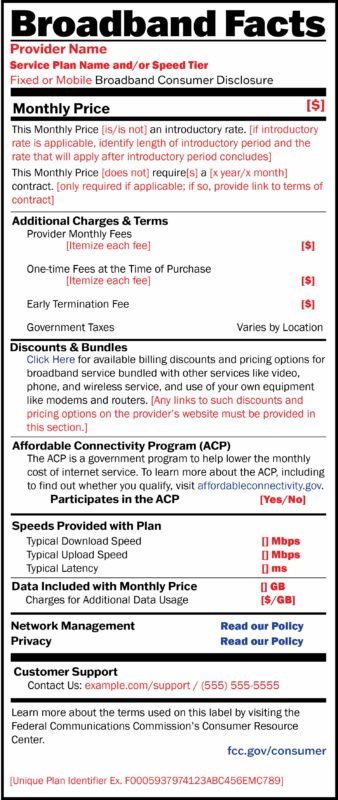

Last year, the FCC proposed a new rule that would require nutrition labels similar to those on food packaging on bills like the one Duteau received.

The rule, if finalized as proposed, would require internet companies to display a standardized Broadband Nutrition Label that discloses their internet speeds, plus fees and prices. That would allow easy comparison between telecommunication companies.

Duteau could then shop for the least expensive, fastest, and lowest-fee internet service. Assuming, of course, she has a choice of providers (97 percent of Americans do).

The new FCC rule would not eliminate junk fees completely, but it could eliminate some of the worst of them. If you can hold a phone company like Lumen to a quoted price instead of letting it add new fees to your bill without warning, that would be excellent.

Here’s another rule that would make sense. The government should require telecommunication providers to prominently disclose any price changes on your bill. Don’t let them just slip it into your next monthly invoice. They should highlight the changes in ALL UPPERCASE AND BOLD.

How much did Lumen owe this customer?

I contacted Lumen on Duteau’s behalf. I felt bad for her because she suspected — correctly, it turns out — that the company had added a modem charge to her bill for more than just a couple of months. And Lumen would only take off the last three charges, so it only agreed to refund her $30.

How much had she paid Lumen? Well, you’ll recall that she’d already purchased a modem. Then at some point — she doesn’t know when — Lumen added a $10 monthly modem lease charge without clearly disclosing it.

How long ago?

Almost four years.

A week later, Duteau received a check for $436 from Lumen. She was stunned. So was I.

She had paid for more than five modems over that period. Words fail me.

She called Lumen about her final bill, which she hadn’t yet paid.

“A representative said it was ‘All taken care of,'” she says.

Seriously? Seriously. Lumen had billed her for a modem that probably cost less than $100 and then billed her another $436.

“I feel like I’ve won the lottery,” she told me. “Thank you so very much for your kind help. I truly appreciate this.”

Here’s hoping Duteau starts reviewing her phone bill every month — and that the FCCs nutrition labels become law. Can’t happen a moment too soon.