When Susan Pauleen’s daughter sent her $1,725 rent payment through Zelle, she had no reason to suspect a problem.

She’d received a routine confirmation from her bank but no hint that her transaction was about to become yet another chapter in an ongoing saga of Zelle scams and accidental money transfers. But it was.

“The number to which she sent the money was just one digit off,” says Pauleen.

The unintended recipient didn’t respond to her daughter’s frantic calls. Pauleen thinks it’s because the person feared they were the target of a Zelle scam. And she wants a refund.

Zelle, a peer-to-peer payment app, is under fire for enabling fraudulent transfers between customers and scammers. (Here are the executive contacts for Zelle.) There’s an ongoing class action suit against Bank of America that claims the financial institution downplayed “huge” security risks of linking Zelle to one of its bank accounts.

The Consumer Financial Protection Bureau (CFPB) is reportedly preparing new guidance that would require banks to reverse fraudulent transfers. Several banks that participate in Zelle, including Bank of America, JPMorgan Chase and Wells Fargo, are reportedly on the verge of announcing plans to refund some customers for fraudulent purchases made through Zelle.

In June 2023, after intense pressure from the government and media outlets such as this one, Zelle’s participating banks started to reverse transfers for some customers who had been duped into sending money to scammers. The fraudsters had claimed to represent a government agency, bank or existing service provider, according to Early Warning Services, Zelle’s owner.

Still, there are so many ways to lose money, not only through Zelle, but other money transfer services like PayPal and Venmo. By the way, here’s my guide on how to get an unauthorized PayPal charge removed.

Fortunately, there are strategies to recover your money and regulations that will help you do it.

If you’re the victim of a Zelle scam, can you get a refund?

If you have a Zelle problem, can you get your money back? That’s what Pauleen wanted to know.

“I would like to get the $1,725 back from the person who received it in error,” she says. “My daughter really needs the money back to pay her rent.”

But Zelle’s terms are clear: You can’t cancel a payment once it’s been sent if the recipient is already enrolled with Zelle. And if you send money to someone you don’t know for a product or service, you may not get your money back for a product or service that’s not delivered.

“Keep in mind that sending money with Zelle is like using cash,” it says.

Pauleen’s case exposes one of the biggest misconceptions when it comes to American money transfers. Conventional wisdom is that there are zero consumer protections. If you send money, it’s gone.

But that’s incorrect.

While there’s a widespread belief that U.S. laws don’t protect consumers when they make money transfers, that belief isn’t grounded in reality. It’s certainly true that other countries have stricter consumer protection regulations. For example, in Germany, you have up to 13 months to challenge an unauthorized debit. Regulations treat electronic money transfers and credit card purchases in a similar way. That may explain why wiring money is far more common in Europe than in the U.S. In Europe, Pauleen could have simply asked her bank to reverse the charge, and it would have.

(Under the terms of the reported deal between Zelle’s participating banks and customers, “fat finger” transactions such as Pauleen’s would not be eligible for a refund.)

But Pauleen’s transfer might be fixable, despite what Zelle claims.

How does a Zelle scam work?

Zelle is one of the preferred tools of criminals. If you don’t believe me, I should let you have a look at our files, which are filled with Zelle cases. At the moment, there are lots of Zelle scams on Facebook. Here are just a few of the recent Zelle Facebook scams from our advocacy files:

Scammed by a childhood “friend” on Zelle

Courtney Sorrells received a Facebook message from a childhood friend who wanted to “bless her” with a $2,500 cash transfer. The catch? She had to pay a $350 processing fee through Zelle. She did. But she never heard from the friend again. “I am sick to my stomach,” she says.

A jacket scam using Zelle

Aidan Dicke got caught up in a scam involving a jacket sold through Facebook. He sent the seller $950 through Zelle in a complicated swindle that also involved several Venmo transactions. “I lost the $950 that I sent,” he says. “My bank investigated the case and determined it was on me to resolve the issue with the receiving party, per Zelle policy, but obviously, I have no way to recover the funds because it was a scam.”

Scammed on Facebook while selling furniture

The Facebook Zelle scam goes both ways. Faith Nessen was trying to sell furniture through the Facebook marketplace, and the buyer suggested that she use Zelle. The buyer overpaid, and she wired the money back to him through Zelle. She lost $1,000. “I am going through a divorce, so I am at a stressful, vulnerable time in my life and I am sad to say I was taken advantage of while selling furniture,” she says.

Zelle is making people deeply suspicious. When Michelle O’Neill transferred $3,000 to a real estate agent by accident, she reached out to the owner of the real estate firm to clear up the misunderstanding. The owner refused to wire the money back, saying she might be a scammer.

“He was rude to me,” she says.

The latest swindle: The Zelle callback scam

The Zelle callback scam involves fraudulent text messages sent from someone purporting to be your bank. The criminals claim that your bank account has been compromised. When you try to call your bank and are placed on “hold,” the scammers call, giving you instructions to wire money to them. Here’s how to avoid the Zelle callback scam.

Is Zelle safe to receive money from strangers?

You should not use Zelle to send or receive money from strangers. Although Zelle is a safe platform for sending money — it uses bank-level encryption and advanced authentication and monitoring features for security — it is not designed for commercial transactions.

Zelle recommends that you use the service to send money to “friends, family or others you trust, such as your personal trainer, babysitter, or a neighbor.” But if you don’t know the person or aren’t sure you will get what you paid for, avoid using Zelle. As an example, Zelle says don’t use the service for items bought from an online bidding or sales site. The transactions, it warns, are “potentially high risk.”

Although Zelle doesn’t offer a protection program for any authorized payments made through the platform, that doesn’t mean you aren’t protected. (Note: Zelle is currently facing several lawsuits from customers who say the company and its bank owners failed to protect them from fraudulent transfers.) Here’s my guide on how the Zelle dispute process works.

How to avoid a mistaken transfer on Zelle

Smart consumers who use Zelle say they have developed an almost foolproof method for avoiding a mistaken transfer. Instead of sending the entire amount, they send a $1 test. If it goes through, then they send the rest. And if it doesn’t, they have only lost $1 instead of the entire amount of the transfer.

Can you make Zelle reverse a mistaken transfer?

It turns out Zelle and other money transfer apps can’t just let you send money and walk away from the transaction.

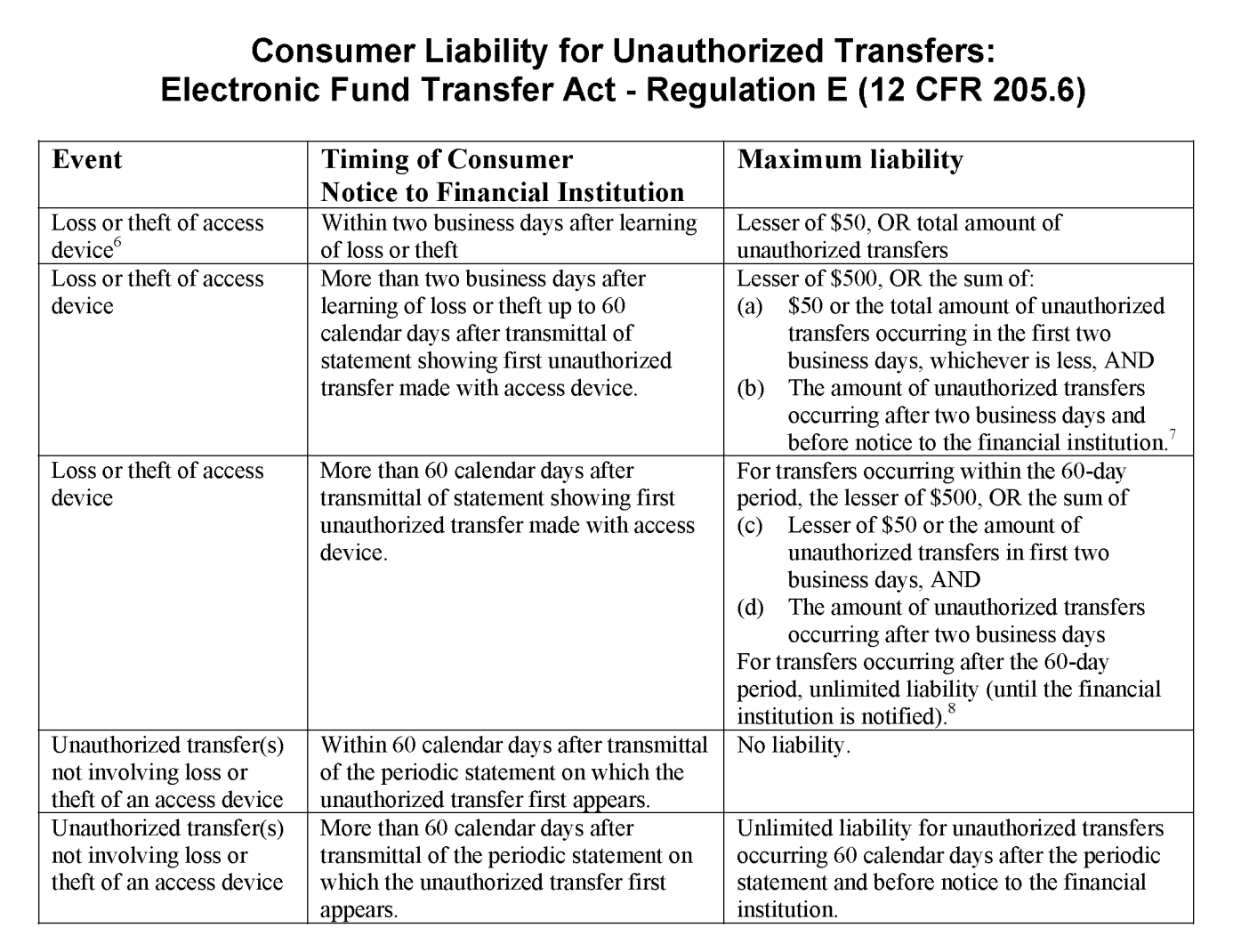

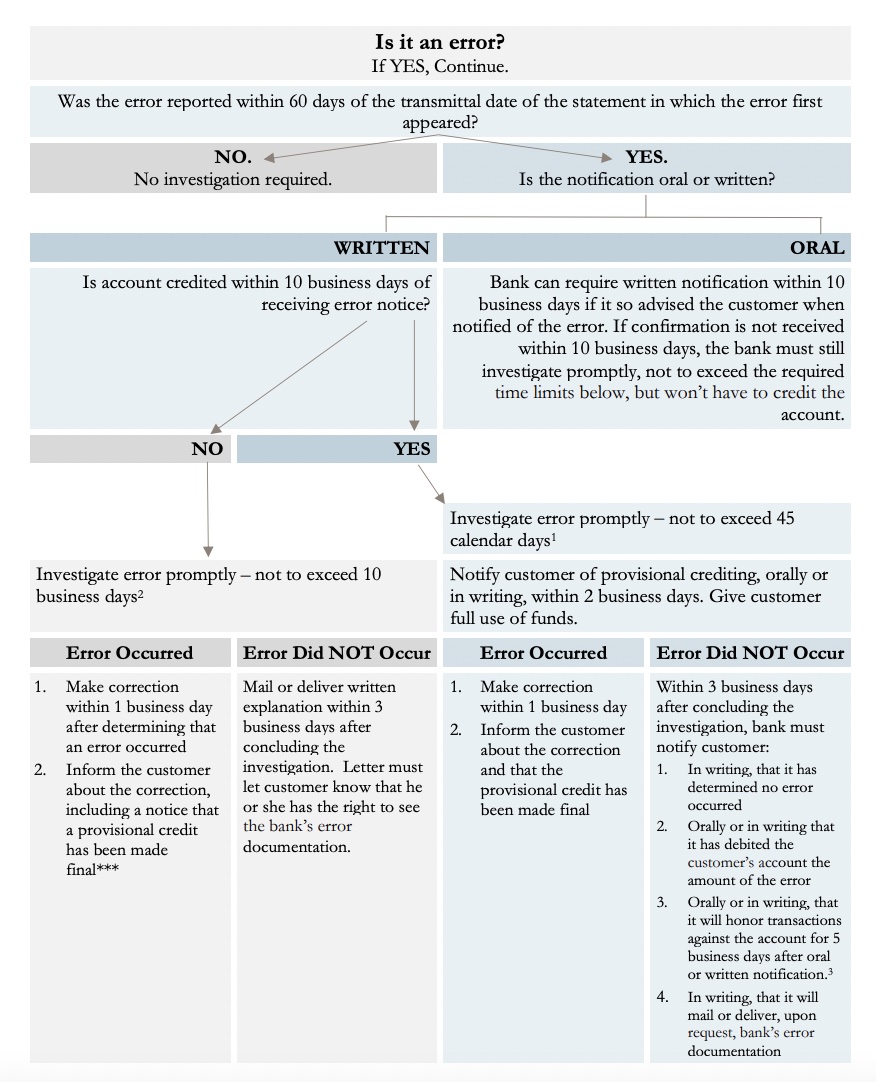

A little-known rule called Regulation E allows you to dispute an ATM withdrawal, debit card purchase or electronic funds transfer. The regulation, authorized under the Electronic Fund Transfer Act (EFTA), protects consumers when they transfer funds electronically.

The law requires that after you notify your financial institution of an error like Pauleen’s, it must:

- Promptly investigate the oral or written allegation of error.

- Complete its investigation within 10 business days.

- Report the results of its investigation within three business days after completing its investigation.

- Correct the error within one business day after determining that an error has occurred.

What’s more, the law sets liability limits so that people like Pauleen aren’t on the hook for thousands of dollars.

What about a peer-to-peer payment, like Zelle? Regulation E protects those transactions, too, according to the CFPB. In fact, the regulation applies to any peer-to-peer payment system that transfers funds electronically.

So how come no one knows about these consumer protections? Banks have little incentive to publicize Regulation E. The financial press, underwritten by generous credit card ads, isn’t exactly falling all over itself to write about Regulation E, either. Ultimately, many consumers are also uninterested in electronic payment protections, preferring to put all of their purchases on credit cards so they can earn more points.

What kind of transactions does Regulation E cover?

Unlike the more structured and formal credit card dispute resolution process, Regulation E generally covers errors. It defines “error” as:

- An unauthorized electronic fund transfer.

- An incorrect electronic fund transfer to or from your account.

- The omission of an electronic fund transfer from a periodic statement.

- A computational or bookkeeping error made by the financial institution relating to an electronic fund transfer.

- Your receipt of an incorrect amount of money from an ATM.

Does Regulation E apply to a fraudulent transaction?

Generally, yes. The regulation defines an unauthorized electronic fund transfer as any transfer from an account initiated by someone without authority to initiate the transfer and from which you receive no benefit.

An unauthorized transfer can include accessing a device that was obtained by robbery or fraud or transfers you were forced to initiate. It doesn’t include transfers where you acted fraudulently or when you gave someone else permission to access your device.

Experts say any situation in which access to a device was obtained through fraud would be covered under Regulation E. So if someone gets your password through a phishing scam and transfers money, Regulation E would apply.

How do you use Regulation E to reverse an accidental transfer?

EFTA outlines the dispute process for erroneous or fraudulent transactions. It’s similar to the process for credit card disputes.

You have 60 days to report the error

Your financial institution must receive your dispute no later than 60 days after the institution sends the periodic statement or provides the passbook documentation.

You have to document the problem

You’ll need to furnish the institution with your name and account number. You’ll also have to point out the error and include the type, date, and amount of the error.

You may have to write a letter

You can initially point out a problem by phone or in person at your bank. But your financial institution may require you to give written confirmation of an error within 10 business days of an oral notice.

Your bank may request additional documentation or clarifications. The law requires a prompt investigation. It gives a bank 10 days to conduct the investigation. It may extend the investigation to 45 days, as long as it gives you a provisional credit.

How do you file a dispute under Regulation E?

Since Regulation E is virtually unknown outside of the financial services industry, few people — let alone customers — know the process of filing a claim. Banks generally don’t offer the same easy ways of filing a dispute, as they do with credit card chargebacks.

You will probably need to call your bank to ask for information about a Regulation E dispute. Your bank may request that you submit the following information in writing:

- Your account number.

- The types and amounts of errors and/or unauthorized transactions.

- When you lost the money and the transaction numbers.

- The date on which you notified the bank of the lost or stolen card or unauthorized transactions.

- The date on which the periodic statement was sent that showed the first unauthorized transaction.

- What kind of resolution you are requesting.

The success of the investigation hinges on whether or not the charge is an error. Your financial institutions will likely argue that it must be a math error committed by you or the institution. But as we’ve already seen the law embraces a broader definition of “error” — one that could benefit you during the resolution process.

How do you fix the Zelle scam problem?

You don’t have to wait for a Zelle scam to take action. Here are some of the things you can do now to avoid having to file a claim under Regulation E.

1. Disconnect Zelle from your bank account immediately

Don’t allow Zelle to have access to your bank account without your permission. That will ensure a scammer won’t be able to siphon your life savings from your account when you aren’t looking.

2. Monitor your account carefully to avoid a Zelle scam

Set up alerts so that you receive a notification when a Zelle transfer goes through. You should monitor your accounts closely, otherwise you could get scammed.

3. Never give your account information to anyone

Many scams start when consumers give information about their Zelle account to strangers. Why would they do that? The strangers are scammers who pretend to be calling from the bank. Once they have your account number and password, let the looting begin. Also, beware of friends and relatives who might ask for your personal information. Trust no one.

4. Double-check the recipient’s number

I can’t overstate this. Even though the law protects you from erroneous transfers, you should take every step necessary to prevent a mistake. That means checking and double-checking the Zelle number.

Ultimately, there’s only one way to ensure you don’t get ensnared by a Zelle scam: Don’t use Zelle.

Disconnect from your bank account. Use a more trustworthy payment method until Zelle adds the necessary safeguards to prevent more cases like these from happening.

My advocacy team furnished Pauleen with this information. We’re waiting to hear back from her, but my team is confident she will get this resolved.

Can you get a refund for a Zelle scam or accidental money transfer?

So can Pauleen get her money back from Zelle? This is a clear case where she can — and will — get a refund. I recommended that she appeal to her bank and, failing that, report the problem to the CFPB.

Financial institutions have conditioned their customers and the reporters who cover them to never question a wire transfer. They claim wiring money is like giving someone cash. That’s false. Regulation E protects you from accidental transfers and some forms of fraud. Use it to get your refund for any Zelle scam or erroneous money transfer.

What should banks do about these Zelle scams?

Zelle needs a dispute system that works like the ones offered by credit card companies. The law already provides a mechanism for enforcing such a system. Now it’s up to the federal government to enforce the law, which it seems poised to do. (I’ll update this article when the CFPB issues its guidance.)

Of course, none of this should be necessary. America’s largest banks, including Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank and Wells Fargo, own Zelle. They should know better. Its owners are well aware that banking is based on trust, and that when you don’t have trust, you lose your customer. It knows what is necessary to build in voluntary consumer protections, but apparently doesn’t want to go through the effort.

Until it does, maybe you’re better off deleting Zelle from your smartphone.

About the art

Artist Dustin Elliott immediately saw the magic in money disappearing from a Zelle account. “But are the banks playing a trick on their customers?” he asks.