The Southwest Chase Visa credit offer Valerie Schreck saw looked too good to be true, as affinity credit card offers often do.

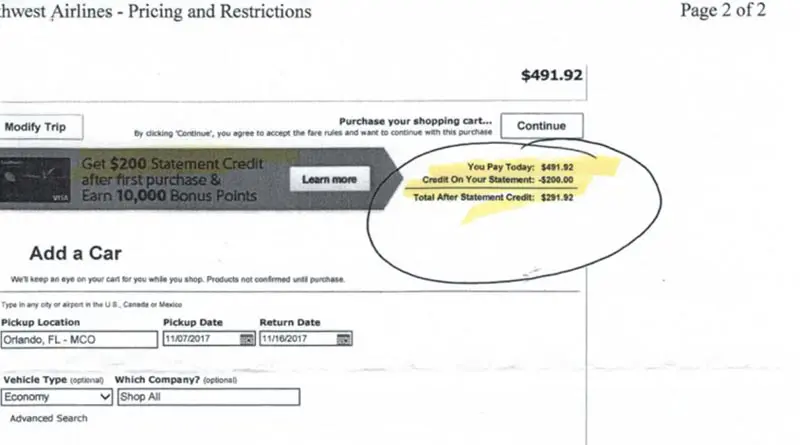

Apply for the card now, the pop-up on Southwest.com promised her, and she could save $200 on her flight.

She applied for the card, only to discover the offer was too good to be true. The $200 credit never showed up.

“That’s the only reason I applied for the card,” says Schreck. “The $200 statement savings was plainly offered when I went to book my flight, with the total amount due, minus the $200 statement savings – again clearly stated.”

Schreck’s case is just the latest in a string of problems with affinity credit cards that promise one thing but deliver another. It’s also the second recent story involving a Chase promotion that didn’t pan out.

Oh, and it’s also unfixable. But that’s OK because there’s an important lesson here for the rest of us: Don’t believe everything you read.

A $200 Southwest Chase Visa credit offer at the end of the booking

“I am beyond frustrated and exhausted and don’t have any other ideas of what to do,” says Schreck.

Here’s what happened to her: Last year, just as she prepared to book a flight from Philadelphia to Orlando, a pop-up screen appeared. “I have the screenshot with my total flight amount minus the advertised $200 statement savings,” she says.

She bought it.

“I’m then told that my $200 statement savings will not apply immediately, but will appear in the next one or two billing cycles,” she says.

Two bills later, nothing.

“So I call Chase,” she says. “After two phone calls and more than five letters, no one wants to apply the statement savings to my account. I’m getting the runaround. I’ve been going back and forth for months!”

The truth about that $200 Southwest Chase Visa credit offer

My advocacy team jumped in to help Schreck with her Chase problem. Southwest deferred to Chase, but not before repeating the bad news:

We contacted Chase on your behalf and were advised that your original offer was 60,000 Enrollment Bonus Points after meeting the $2,000 spending requirement. Chase also advised they are unable to honor any other promotional offer.

We apologize for any disappointment this may cause you.

In other words, the offer you thought you signed up for — the one you have screenshots of — that’s actually not the one you have.

Really? Really.

Our advocacy team rattled Chase’s cage on behalf of Schreck.

“Needless to say, I am not a happy camper,” she said afterward. “Despite all my efforts, and yours on my behalf, they are steadfast in the response that the $200 Southwest Chase Visa credit offer is not the promotion for which I applied.”

The Chase representative announced it would not honor the offer on her screen and had decided to “close the case.”

“How is it they can do that?” she asked. “How can they falsely make those offers on screen, and show you the savings, and then renege on them when challenged? It’s misleading, and to be honest, quite unfair.”

And now, a few words about affinity credit cards

So here we have a case where someone has an actual screenshot of an offer, where the price of an airline ticket has been reduced, and it’s a no-go. Apparently, the Chase customer service agents have been reading too many dystopian novels on their lunch breaks. They’re telling Schreck she’s not seeing what she’s seeing. They’re telling us that we’re not seeing what we’re seeing. (Related: I canceled my credit card, so how will I get my concert refund?)

Nothing to see here. Move along.

Enough with the doublespeak. Do I need to give you my opinion on these toxic financial instruments? No, I don’t need to tell you about the credit card fan blogs that have polluted the internet with their affiliate arrangements. Do I have to review all the broken promises that other affinity cards have made in the past? The hundreds of millions of dollars in late fees they’ve inflicted on users like Schreck?

Why should someone like Schreck be surprised by Chase’s broken promise? Why should anyone be?