Forecasters say it will be another busy Atlantic hurricane season, leading many travelers to ask: If your vacation is ruined by a hurricane, will it be covered by trip insurance?

The short answer is: sometimes.

Consider what happened to Norman Fitton, who paid $2,615 for a vacation rental in Kitty Hawk, N.C., a few years ago. Unfortunately, a hurricane made landfall at Cape Hatteras during while he and his wife were on vacation.

But for Fitton, the experience was a lesson in the limits of trip insurance and the liability of renters. And like Dorian’s dramatic encounter with North Carolina, it almost ended in disaster.

When does travel insurance cover a hurricane?

Most travel insurance covers hurricanes — to a point. But the covered event must be unforeseen; in other words, you can’t buy travel insurance after the hurricane forms, hoping your insurance company will cover it.

Travel insurance can cover you for any prepaid and non-refundable trip expenses, including a vacation rental. But travel insurance policies have significant restrictions. Your flights must be delayed for a significant amount of time (usually a day or two), and your hotel or vacation rental must be closed for several days. Read the fine print carefully. (For more travel insurance buying advice, check out my ultimate guide on travel insurance.)

They knew their vacation was in trouble when this happened

The Fittons knew their vacation was in trouble when they received a troubling email from their vacation rental management company. It said local authorities had issued a mandatory evacuation order for all guests vacationing in the towns of Duck, Southern Shores, Kitty Hawk, Kill Devil Hills, Nags Head and South Nags.

The rental company said guests “MUST pack up all of their belongings and evacuate the Outer Banks.”

Fitton wondered if he’d be liable for the missed nights in his vacation rental. Would a hurricane be covered by trip insurance?

There are thousands of vacation rental guests asking the same question now, in the aftermath of Hurricane Idalia, which is barreling up the East Coast of the United States.

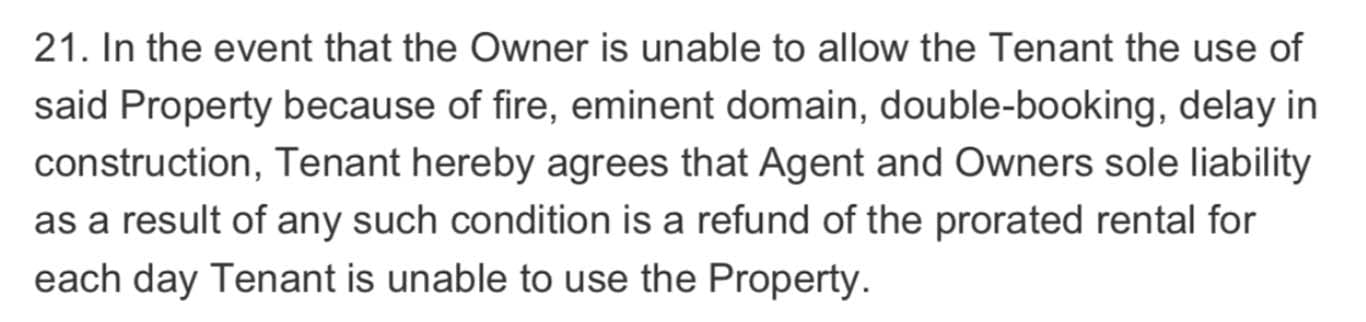

Fitton took a look at his rental contract. It looked as if he might be able to get a refund for the unused days.

Hurricanes and travel insurance coverage

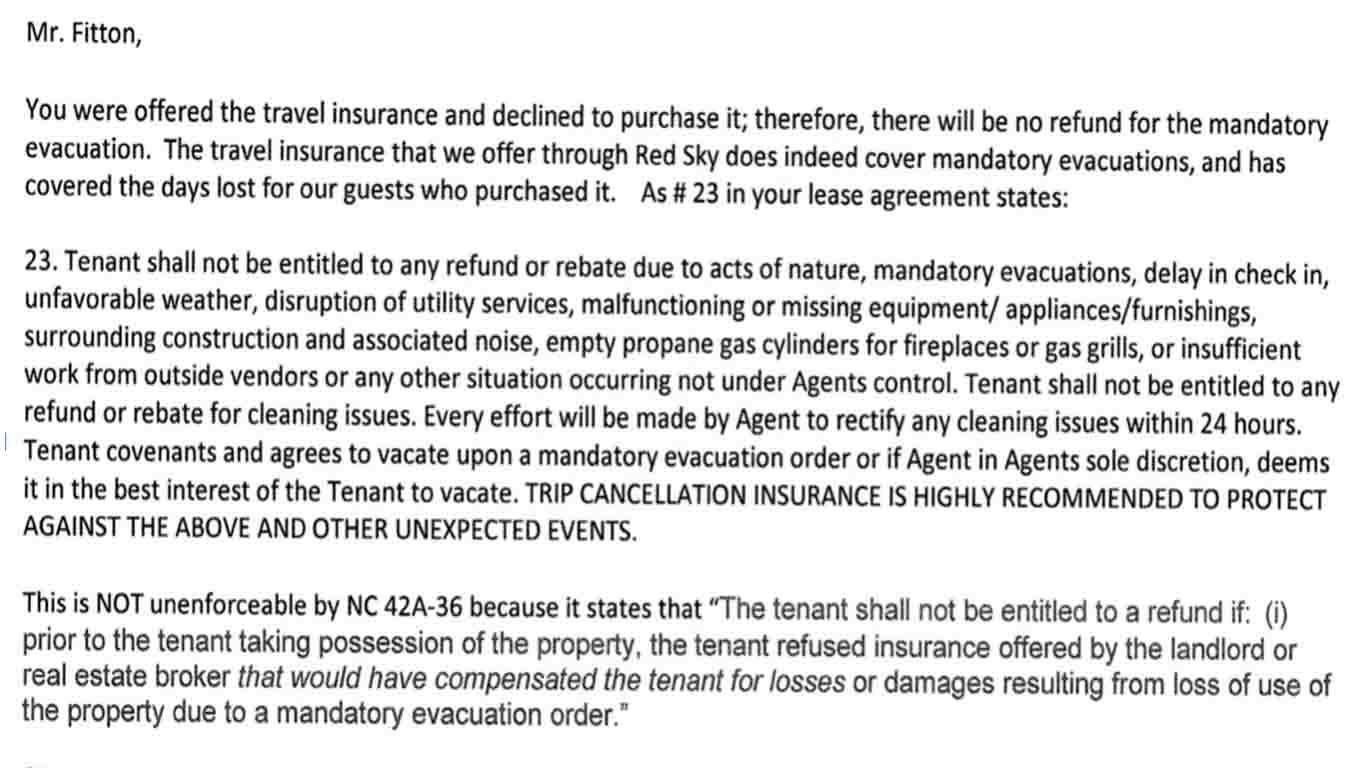

But the property management firm, OBX rentals, saw it differently. It turns out the contract addresses hurricanes a little later, as the rental agent explains.

Is this vacation renter out of luck?

Fitton wasn’t happy with that response.

“The homeowner gets to keep the renter’s money and the real estate agent gets to keep the commission on the rental,” he says. “The renter not only loses their vacation for a home that can’t be used, but has to pay for it.”

Imagine if the hotel industry adopted similar policies, he adds.

“What if the hotel burned down, but you prepaid for the room?” he asks. “Do they get to keep your money?”

Good question. As a matter of fact, I’ve seen hotels try to claim an “act of God” excuse and pocket a guest’s money, but it’s rare. And, of course, airlines routinely invoke the Almighty to deny their passengers a meal or hotel room after a flight delay. But that’s a whole other topic.

“We think we are out of luck,” he adds. “But wish someone had alerted us to read the fine print in the lease.”

At the very least, Fitton wanted my advocacy team to warn other renters to make sure they understand the fine print and the terms of their travel insurance.

“You may need to hire an attorney,” he joked.

Or you could contact us.

Insurance would have helped for this vacation ruined by a hurricane

As it turns out, the Fittons only lost one day of their Outer Banks vacation — about $264. My advocacy team reviewed the file and confirmed that the contract would not allow for a refund.

Is it fair? To the owner and the vacation management company, maybe. But placing the burden for an act of God on the renter is not so fair. And since this is an adhesion contract — a take-it-or-leave it proposition — I’m really having a difficult time seeing how this is consumer-friendly.

Sure, Shoreline OBX offers optional travel insurance. But I’m skeptical of the policy. Travel companies such as cruise lines and vacation rental management companies push these policies on their customers because they get a generous commission. Exclusions often riddle the coverage.

Related reads

Don’t want a hurricane to ruin your vacation? Timing is everything

Here’s my advice for avoiding a loss like the Fittons’: Mind the calendar. The Outer Banks of North Carolina in September is a beehive of hurricane activity. If you don’t want to run the risk of a hurricane ruining your vacation, plan something in late spring or late fall. Summer gets crazy there.

Read the contract v-e-r-y carefully. Had the Fittons studied their contract, they would know that they were liable. And they could have either accepted the less-than-favorable terms or opted for insurance.

Buy insurance from a reputable source. I’ve never heard of Red Sky insurance. For all I know, it might be a terrific policy. But I’d recommend sticking to a major name brand like Allianz or Generali.

I don’t want to sound too critical of Fitton. After all, the contract Shoreline OBX slid under his nose, while pretty standard, was a dense, difficult read. But I can’t overemphasize the importance of reading any agreement that you enter into when you’re a consumer, whether it’s a warranty for an appliance or an airline ticket contract. Know before you go.

A happy ending for this vacation ruined by a hurricane?

We had some bad news for the Fittons. The contract made it impossible for us to get involved in the case. But, she wondered, had they made their purchase using a credit card? If so, the card might offer a trip insurance benefit.

They had.

Fitton checked with his credit card company, explained the situation to them, and came back with some excellent news.

“I have coverage through my credit card company,” he said.

Interestingly, his credit card changed its coverage on Sept. 22 and would no longer cover vacation rentals. Those benefit reductions are becoming all too common, as credit card companies, flush with cash, look for ways of maximizing their profits. But Fitton’s credit card honored his claim because the event took place before Sept. 22. (Related: Canceled our tour after a hurricane, how about a refund?)

“The moral of the story is that, as always, the buyer needs to be extremely diligent in researching the entire situation,” Fitton says. “In North Carolina, the law stacks the deck against the renter. While the house can’t be legally occupied, that liability falls to the renter unless they purchase travel insurance. Had the realtor explained any of this to us in advance, we would certainly have taken the travel insurance, but my independent reading of it led me to believe it wasn’t of value unless 50 percent or more of the trip was lost.”

If you’re heading to the Outer Banks or the Florida Keys during hurricane season, pay extra close attention to the contracts you sign — and consider travel insurance. I know the Fittons will the next time they visit North Carolina. You also need to be aware of scammers — but that is a story for another day.

✋ Your turn

Have you ever been denied a refund after a canceled flight? Should airlines be held accountable no matter the cause? Let us know what you think.

FAQ’s

Yes. Regardless of the cause — weather, maintenance, or otherwise — if the airline cancels the flight, you’re owed a refund under U.S. DOT rules.

Yes. If one segment of your booked itinerary is canceled and it prevents you from completing your trip, it counts as a cancellation.

You don’t have to accept it. Politely decline and request a full refund. Use DOT guidelines to support your case.

The new rule requires airlines to automatically issue refunds for cancellations and significant delays. If they don’t, you can report them to the DOT.

It varies, but airlines are required to process refunds within seven business days (for credit card purchases) or 20 days (for cash/check). Keep following up if they delay.

Pro tip: If your flight is canceled, don’t accept a travel credit unless you plan to use it. Insist on a refund — in writing — and cite U.S. Department of Transportation rules. You’ll usually get results faster.

Key takeaways

- If an airline cancels your flight — for any reason — you’re entitled to a full cash refund, not just a flight credit.

- A partial leg cancellation (like Tampa to Dallas) still qualifies as a full cancellation if it disrupts your itinerary.

- A new federal rule now requires automatic refunds for canceled flights, but enforcement may lag.

- Airlines may resist refunding until pressured, even when it’s clearly required by law.

- Persistence and proper documentation (emails, call logs, screenshots) are essential to winning your case.