When Kathryn Stewart rented a car in Munich, Germany, she assumed it would cost $260. After all, that’s what her car rental company had quoted her. She didn’t expect to pay $800 in extra car rental insurance. But she did — and now she wants help with a refund.

Stewart’s case is a reminder that quotes and verbal promises are meaningless. The only thing that matters — the only thing! — is the document you sign when you rent your car. It’s a tough lesson that Stewart learned when she found a $1,060 charge on her credit card. But don’t worry, there’s a happy ending to this story.

How she ended up with extra car rental insurance

Stewart says she rented a car from Hertz through Auto Europe, an online agency.

“At the time of the rental, I told the clerk I did not want any of the extra insurance as my credit card covers damage or loss to a rental car,” she says. She says the employee understood and agreed not to charge for the insurance. “On my return, I found that I had been charged for the insurance – about $800 on a two-week rental that cost me $260.”

She immediately saw the new bill and asked to speak with a manager.

“But she did not have access to the paperwork and I had left my copy in the car, which was now long gone,” she remembers. “I hurried off to catch my flight.”

When she returned to the States, Stewart filled out a customer service request form with both Auto Europe and Hertz.

“Hertz ultimately responded saying they needed to wait for the digitized contract to reappear in their system,” she says. “When they did send me the copy of the contract — lo and behold — there was my signature and initials on what appeared to be a contract accepting the extra car rental insurance coverage.”

She says she would have never knowingly signed such a contract.

“I was very clear with the clerk that I did not want the extra car rental insurance. I’m not sure what error or sleight of hand can account for this discrepancy,” she says.

Warning: These shenanigans are a persistent problem!

Although this story first appeared in 2019, the problem of unwanted extra car insurance charges has not gone away. Far from it.

My advocacy team just handled a case from John Clarke, who rented a car through Europcar via Expedia. When he arrived at the rental counter, a representative told him he’d have to pay another $627 for insurance, or he couldn’t get a car. “I had no other alternative,” he says.

I reviewed his case and contacted Expedia on his behalf, and it refunded his $627. But it took months, and it should have never happened in the first place.

What really happens when you’re at the car rental counter?

According to Stewart, she signed an electronic pad before receiving the keys to her car. More car rental companies rely on sophisticated tablet-based systems that capture your signature and other preferences when you rent a vehicle. These systems can save time and money, but unscrupulous companies can also use them to dupe their customers.

Stewart had instructed the car rental employee to remove the insurance option and believed she was signing for a car without extra car rental insurance. She says the employee assured her that her signature was for the $260 in rental charges and that she’d declined the $800 in extra insurance.

Car rental companies make a lot of money from selling extra car rental insurance, so it’s no surprise that they’re a little aggressive when it comes to asking their customers to buy it. How much money do agents earn? An investigation by the International Business Times found that an agent earning minimum wage could pull in as much as $100,000 in commissions per year. One Dollar Thrifty manager in Raleigh-Durham says one of his employees earned $75,000 a year, “in part by telling customers that if they bought the insurance coverages, he wouldn’t charge them for an upgrade.”

Here at Elliott Advocacy, we even had a recent case in Germany where a car rental employee falsely told a customer that extra car rental insurance was mandatory.

I publish a few useful tips on how to avoid extra insurance scams for rental cars.

Bottom line: Car rental companies employ counter staff not just to execute your rental agreement, but to sell you more. They want you to select their pricey insurance, an upgrade, a GPS device, a full tank of gas, and everything else they have to offer. The counter is a sales platform.

Stewart says she didn’t need the insurance because she already had coverage through her credit card.

“At this point, it is just my word against theirs — along with the mind-boggling illogic of paying $800 for insurance coverage that I already had for free,” she says. “When I get off an overnight flight all dazed and confused and wait impatiently at the rental car counter and the clerk says initial here and here and sign here, I must admit I never considered it necessary to read carefully and just assume that my clearly expressed wishes have been followed. But you can be sure I will be much more careful in the future. In the meantime, I hope you can help recover the money from Hertz.”

Do car rental companies try to trick you into buying extra car rental insurance?

For decades, car rental customers have contended that companies try to trick them into buying unnecessary insurance. The hard-sell that Stewart experienced is a common and time-tested strategy for padding a rental company’s profits.

Car rental companies say drivers need insurance and that they’re providing an important service. And while that’s correct, it is also true that the optional insurance sold by car rental companies is wildly overpriced. Consider Stewart, whose rental costs more than quadrupled when Hertz added insurance.

Most travelers would say that’s unreasonable. Imagine if your homeowner’s insurance costs four times as much as your mortgage. Outrageous.

Car rental companies had to put the cash machine in “reverse” in 2003, when Enterprise agreed to pay $2 million in restitution to New York motorists who bought unnecessary liability insurance.

Authorities contended that Enterprise told customers that it provided no insurance. The car rental company induced consumers into purchasing liability insurance, known as Supplemental Liability Protection, at an extra cost of $6.95 to $7.95 per day.

“The court order compensates consumers who were deceived into purchasing liability insurance through Enterprise even after the state’s highest court held that rental car companies are required by law to provide coverage for their renters,” New York’s attorney general Eliot Spitzer said at the time.

More recently, several customers sued Dollar Thrifty, alleging the company duped them into buying additional insurance that they probably already had coverage for under their car insurance policies. The plaintiffs said Dollar Thrifty had a duty to warn customers that their personal auto insurance policies and credit cards sometimes offer car rental coverage.

The complaint alleged that Dollar Thrifty representatives charged customers for liability insurance even after the customers declined it. The plaintiffs noted the company routinely used electronic signatures to indicate that customers wanted liability insurance, when the customers had indicated on a touch screen that they did not want the insurance. The parties reached an undisclosed settlement in 2017.

Does she have a case?

I thought Stewart might have a case. If I could show that Hertz intentionally misled her, perhaps by showing her a contract in German or encouraging her not to read the document, it might be enough to compel Hertz to refund her money.

First stop: her paper trail. I reviewed her well-written appeal to Hertz, in which she recounts the rental and explains that her credit card already covers insurance.

Here’s the final Hertz response:

Unfortunately, as you accepted the Loss Damage Waiver and Theft Protection at the time of rental the charges [sic] are valid. As the you [sic] provided a copy of your credit card benefits this must be done at the beginning of your rental. While I understand this is not the outcome you were anticipating, I hope you will respect our position on this matter as we consider it having been fully addressed and case closed.

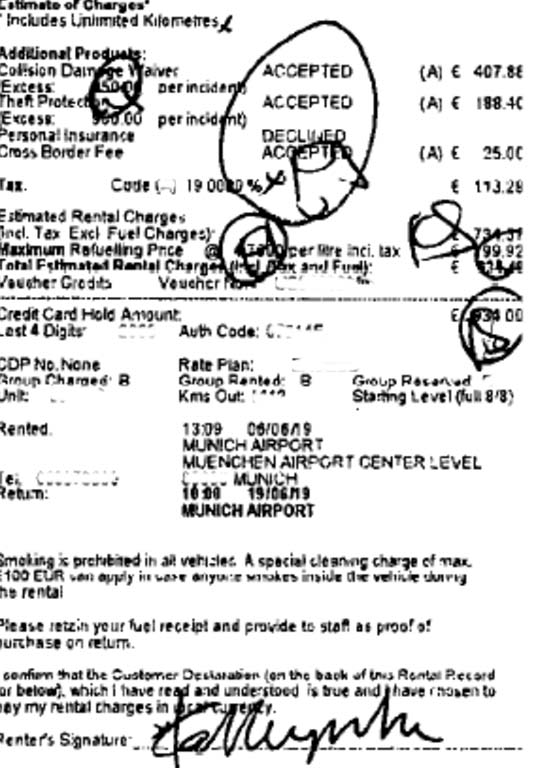

And finally, the evidence that she had indeed signed up for the extra car rental insurance:

How frustrating. To find out if this case is fixable, I started by asking her if she had any written evidence that she declined the extra car rental insurance?

“Security camera footage. . . DNA analysis. . . hair and fibers from the scene. . . I’m afraid I can’t think of anything other than my very distinct memory. I was so amazed when they sent me the contract with my signature,” she says. “I only have the benefits statement from my credit card indicating that I have the coverage through the card.”

OK, that’s not really enough.

“As you can imagine, it’s very frustrating,” she added. “I remember the conversation with the agent at the desk quite clearly when I declined the insurance. He applied a little pressure to get me to take it, but I clearly stated I didn’t want or need it and he responded that as long as I brought the car back “without a scratch” I would be fine. I don’t like to believe that he did something deceptive to get my signature on the contract accepting the insurance, but it’s hard not to be suspicious.”

But talk is cheap. There is no record of the verbal promises made by the associate, unfortunately.

Next, I asked her if she recalled the name of the agent. Did he offer a receipt at the time of her rental for her to review?

“Unfortunately, I don’t remember the name of the agent who I dealt with at pick up,” she says. “The only receipt I have is what they gave me when I returned the car along with the digitized receipt they forwarded to me with my signature apparently accepting the insurance. I feel totally bamboozled!”

ere’s another potential scenario to consider: Was the agreement written in German? It wouldn’t be the first instance where language differences caused complications in vehicle insurance matters.

“I don’t know,” she told me.

Here’s what I did with this case

I wanted to share this case with my contacts at Auto Europe and Hertz. But I couldn’t.

Stewart signed a contract without reading it. The car rental company had a contract with her signature on it.

Did the Hertz employee in Munich try really hard to get Stewart to buy the expensive extra insurance? Without question. Did he intentionally fail to remove the optional insurance, as she requested? Possibly. Does she have any basis in requesting a refund? I can’t think of any.

Stewart’s case is a learning opportunity for the rest of us. Any time you rent a car, make sure you do the following:

- Research your insurance options and requirements. Stewart’s MasterCard offered plenty of coverage for her vehicle. Insurance should never cost four times as much as the rental. You can always go to a site like InsureMyRentalCar.com for a better rate. If you’re renting overseas, bring all documentation for your insurance, including your cardmember agreement.

- If an associate tells you that you don’t have enough insurance, ask for a manager. A supervisor can rein in an employee who is trying too hard to sell insurance. Your “no” should be enough to send you on your way with the insurance you already have.

- Always, always, always read before you sign. That’s especially true if you’re renting outside the country or where there’s some discussion about options. You want to know what you’re signing for and most importantly, your total cost. Pro tip: If you sign up for one of the car rental loyalty programs, you can select your preferences and speed through the rental process without having to deal with a salesper … uh, I mean, employee. If you don’t want to sign up for the loyalty program (I wouldn’t blame you), then use an electronic kiosk.

- And read after you sign, too. Take a look at the printout or the receipt your car rental company emails you before your drive off into the sunset with your rental car. If something looks off, don’t leave the lot. Once you do, it will be much harder to fix the problem. Keep all the documents.

- Take names. Stewart might have had a chance at resolving this case if she’d noted the name of the associate who helped her. Even taking a picture of the employee might have jogged someone’s memory at Hertz. But without the documentation, her case was impossible to resolve.

I hate cases like this. But Auto Europe and Hertz probably do, too. I believe the folks at the corporate level are embarrassed by these incidents. And they’re afraid that they might lead to yet another lawsuit. The $800 they made from Stewart’s insurance is just not worth the years of anger they’ll have to endure from her.

She may have no case, but she has every right to feel the way she does.

Here’s the surprise update!

Shortly after this story appeared on Aug. 6, I heard from Stewart.

“A miracle has occurred,” she told me.

Hertz refunded the $800 in insurance charges.

How did that happen? Stewart had written to Hertz’ CEO after I supplied her with a name and email. But Hertz also saw her story on this site. And, as I previously noted, I think it didn’t like what it saw.

“Chris, I have learned my lesson,” she added. “I do appreciate your helpfulness as I worked through this process as well as the inspiration and support that your column and website provide.”