Jennifer Chilton is outraged because her friends have been denied travel insurance coverage on a technicality. Will they really lose $10,074 because of a clause in the fine print? Find out.

Question

I’m writing on behalf of two friends who booked a trip of a lifetime to Italy recently. They also purchased trip insurance through Access America. A couple days after paying for the insurance, they found out that the husband had to have hip replacement surgery. It was a situation that became chronic within a couple of days.

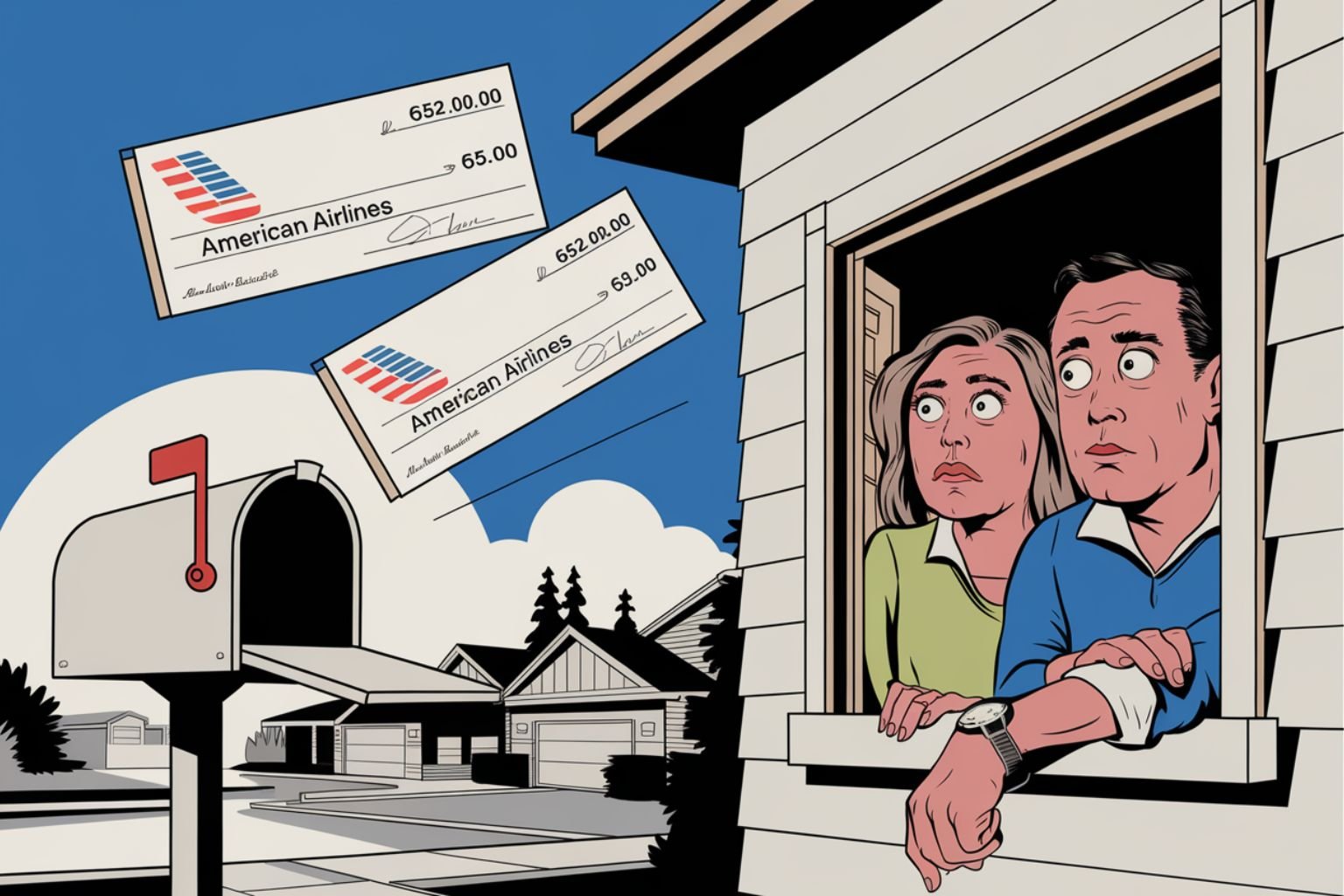

The entire cost of the trip was $10,074. However, they didn’t read all of the fine print in the terms and conditions and didn’t realize that no refund would be available to them for cancellation due to a pre-existing condition because they didn’t purchase insurance on the full cost of the trip — only $10,000 of the trip.

I find it very disturbing that a couple who has worked so hard for their money, and purchased a trip in good faith, along with travel insurance, could find themselves in this predicament. Not all consumers are as computer savvy as others and they would never have purchased insurance for less than the full amount of the trip if they knew it voided the provisions for cancellation due to a pre-existing condition.

They saved $74, but they lost more than $10,000.

Personally, as a consumer, I find this practice revolting and would appreciate any suggestions you could offer. — Jennifer Chilton, High Point, NC

Answer

You’re right, this is a frustrating case, and I can certainly understand your anger. Basically, Access America is denying your friends’ coverage because they didn’t insure the full value of their trip.

My advocacy team and I had a lengthy conversation with the company about your friends. According to the terms of their coverage, they had to buy their insurance within 14 days of making their first trip payment or deposit and had to purchase trip cancellation coverage for the full cost of their nonrefundable trip arrangements. In addition, they had to be a U.S. resident and medically able to travel on the day they purchased their insurance.

Your friends met all but one of those criteria: They failed to insure the full cost of their nonrefundable trip arrangements. (Related: The unauthorized guide to fine print, holiday edition.)

“It’s important for customers who need existing medical condition coverage to understand and meet the terms for this very valuable benefit,” a company spokesman told me.

Would an insurance company deny you $10,074 in coverage because you tried to save a buck or two on your policy? You bet. Is it ridiculous? If you’re a traveler, you bet. If you’re an insurance underwriter, maybe not. (Here’s our guide to finding the best travel insurance.)

Look, at the risk of repeating myself, you need to read the fine print carefully when you book travel — but especially when you buy travel insurance. I understand when you say not all consumers are as computer savvy, but if you’re not sure of something, you need to find a travel agent to help you or ask a family member who is computer savvy to review the fine print online.

Access America decided to “make a consideration in this case” and will honor your friends’ claim.