Good luck avoiding junk fees when you travel this summer.

There are transaction fees, convenience fees, resort fees — and a beef-cost surcharge.

That’s what Alan Levine says he found on his bill when he stopped at a steakhouse in Moab, Utah, recently.

“My server claimed the beef-cost surcharge was standard,” says Levine, a retired editor from New York. “But I had ordered chicken.”

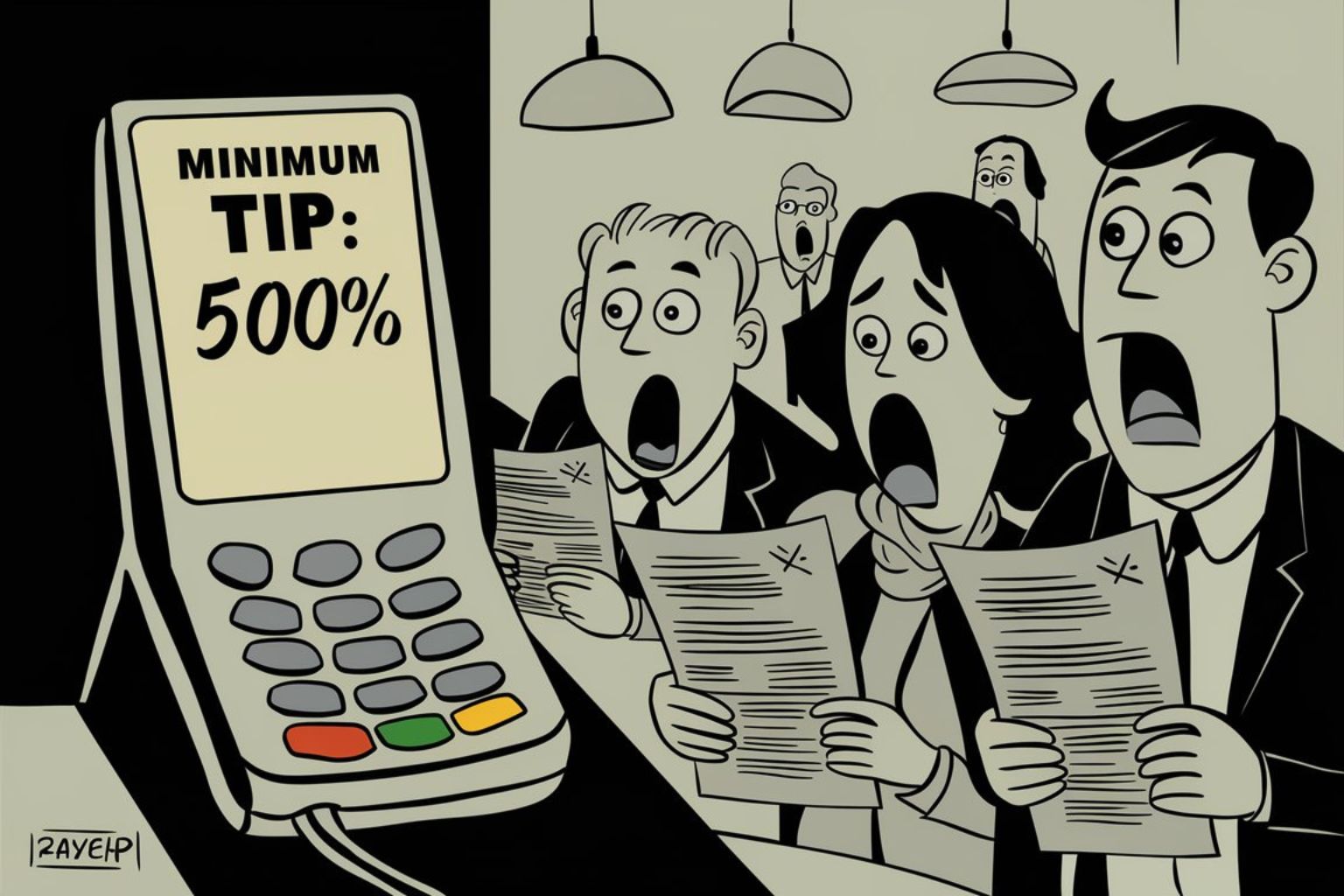

Junk fees — hidden, mandatory extras added to your final bill — have mushroomed in recent months and travelers are crying foul. The government is waging a public war against these annoying extras, but businesses still love hitting their customers with extras because fooling them into paying more is highly profitable.

How much do they love them? Consider what happened when the Department of Transportation (DOT) recently said it would start requiring airlines to quote an all-in price on airline tickets instead of separating fees for carry-on luggage and canceling or changing a reservation. In response, the airline industry sued the DOT last week, claiming it had overreached its authority.

But the latest junk fees are too much, and as it turns out there’s a reason they’re multiplying. There are also proven ways to avoid these unethical extras.

The latest junk fees cross a line for travelers

Fees are everywhere when you travel — and worse, companies seem completely unwilling to remove them.

- Junk fees are getting creative. Instead of a mandatory resort fee in addition to the room rate, tour operator Phyllis Stoller found a $30-per-day “urban fee” on her Los Angeles hotel bill. The fee covers a daily newspaper, phone calls and free internet. “I wasn’t paying attention when I checked out and paid it,” she says.

- The unwanted extras are often impossible to justify. How about a 3 percent transaction fee? That’s what Robert Kraus, a meeting planner from Alexandria, Va., found on his recent hotel bill in Chicago. When he asked about it, a representative told him it was to cover the cost of paying by credit card. So Kraus offered to pay with cash. “They said they couldn’t waive the fee,” he says.

- Often, the fees can’t even be explained. Alan Craig, the retired CEO of an automotive accessories company, recently found a $2 surcharge at a hamburger restaurant. No one could tell him what it was for or whether it was mandatory. “I paid it, but I let them know these fees are bad for business,” he says.

Bottom line: Travelers will probably feel like they’re drowning in junk fees this summer. They’ll be kicking themselves because somewhere in the fine print or on their hotel folio, the mandatory extras were disclosed. And businesses have proved reluctant to remove the junk fees.

Why are there so many junk fees?

Why are junk fees spreading despite government intervention? Businesses are under relentless pressure to turn a profit, and junk fees are a shortcut to higher earnings, say experts.

“Appearing to provide the lowest cost of travel is a great way to attract customers,” says Eric Chaffee, a law professor at Case Western Reserve University. “Even if it is, in fact, not true.”

That’s especially true of airlines, and one reason why the U.S. airlines are suing the federal government. The true cost of flying is far higher than the airfare you’re being quoted.

“Airlines have begun to charge for a lot more things in order to stay in business,” adds Chaffee. “Hiding these fees until later is one way of ensuring that.”

But hiding fees — basically, not disclosing the true price of your product — irritates customers. Price transparency, which is what the government wants, “is the fair thing to do,” he says.

It’s not just airlines that are being targeted by the government. A California ban on junk fees, which will outlaw many restaurant surcharges, will go into effect on July 1. And there, too, the restaurant industry is reportedly considering a lawsuit to fight the ban. (The law disappointingly allows car rental companies and car dealerships to continue charging some fees. Oh well, you can’t win ’em all.)

Bottom line: There are so many junk fees because they make businesses so much money.

How to avoid junk fees this summer

You don’t have to be a victim when you travel this summer. You can avoid most junk fees with a few simple precautions.

Always read the fine print. Junk fees are often hidden in plain sight. Businesses disclose them on their websites or in the confirmations they email you. They read them to you over the phone in monotone (they’re reading from a script). They tell you in a way that’s utterly forgettable. That’s why you have to pay attention when you travel. Don’t zone out. Read the fine print.

Fee-proof yourself. One way to protect yourself from fees such as luggage surcharges is to join an airline loyalty program (although I’m not a fan of loyalty programs, as I’ve noted before). “Obtaining status can help you save money in the long run,” says Bob Bacheler, the managing director of a medical transportation service, and a frequent traveler. (But just be careful to not trade one set of fees for another. Some co-branded credit cards have high annual fees.)

Go fee-free. There are travel companies that have taken a stand against junk fees. (Alas, some are not.) For example, Southwest Airlines doesn’t charge passengers for checked or carry-on luggage. Most name-brand car rental companies (Avis, Enterprise, Hertz) quote all-in prices. The other car rental companies, not exactly. Find these fee-free businesses and patronize them. It sends a message that you want fair pricing.

What to do when you’re charged a junk fee this summer

You can read the fine print, join a loyalty program and patronize a fee-free business but still get stuck with a junk fee this summer. Yeah, that’s how pervasive they are.

Levine, the editor who got slammed with a beef-cost surcharge for his chicken dinner — and was told that it was a standard charge — had a ready response.

“I told them that my standard way of dealing with thieves is to walk away,” he says. “They took the charge off the bill.”

I have another idea: If a business hits you with a hidden junk fee, you need to do three things. First, let the company know that you are unhappy with the fee and ask it to remove the charge. Second, never do business with the company again.

And third, warn everyone you know about the unethical whether it’s on social media, a letter to the editor, or a review on a restaurant website. Sooner or later, it will get the message.