Rachael McHenry is sure her hotel made a billing error. The Comfort Suites Paradise Island offered her a $150 food and beverage credit but then charged her credit card $111 for dinner, anyway.

“Our server assured us the hotel would reimburse us for the charge,” she says. “Now the hotel refuses to respond.”

She’s right. McHenry’s billing error is just one of several types I see regularly. Hotels erroneously bill guests for extra nights, for damage to the room, and for souvenirs allegedly taken, like bathrobes and pillows.

It’s maddening because the hotel has a guest’s credit card and can simply charge whatever it wants. Often, the credit card company automatically sides with the hotel, even when there’s minimal documentation.

But McHenry isn’t out of luck, and neither are you. I’ll tell you how to fight a hotel billing error — and win.

Before I get into it, though, a disclaimer: Please use these insider strategies only to fight an actual error, not to get out of paying a legitimate bill. Running a hotel is hard. The last thing hotel operators need is a travel hacker trying to evade a legitimate charge.

[ez-toc]

Maybe she could see this hotel billing error coming

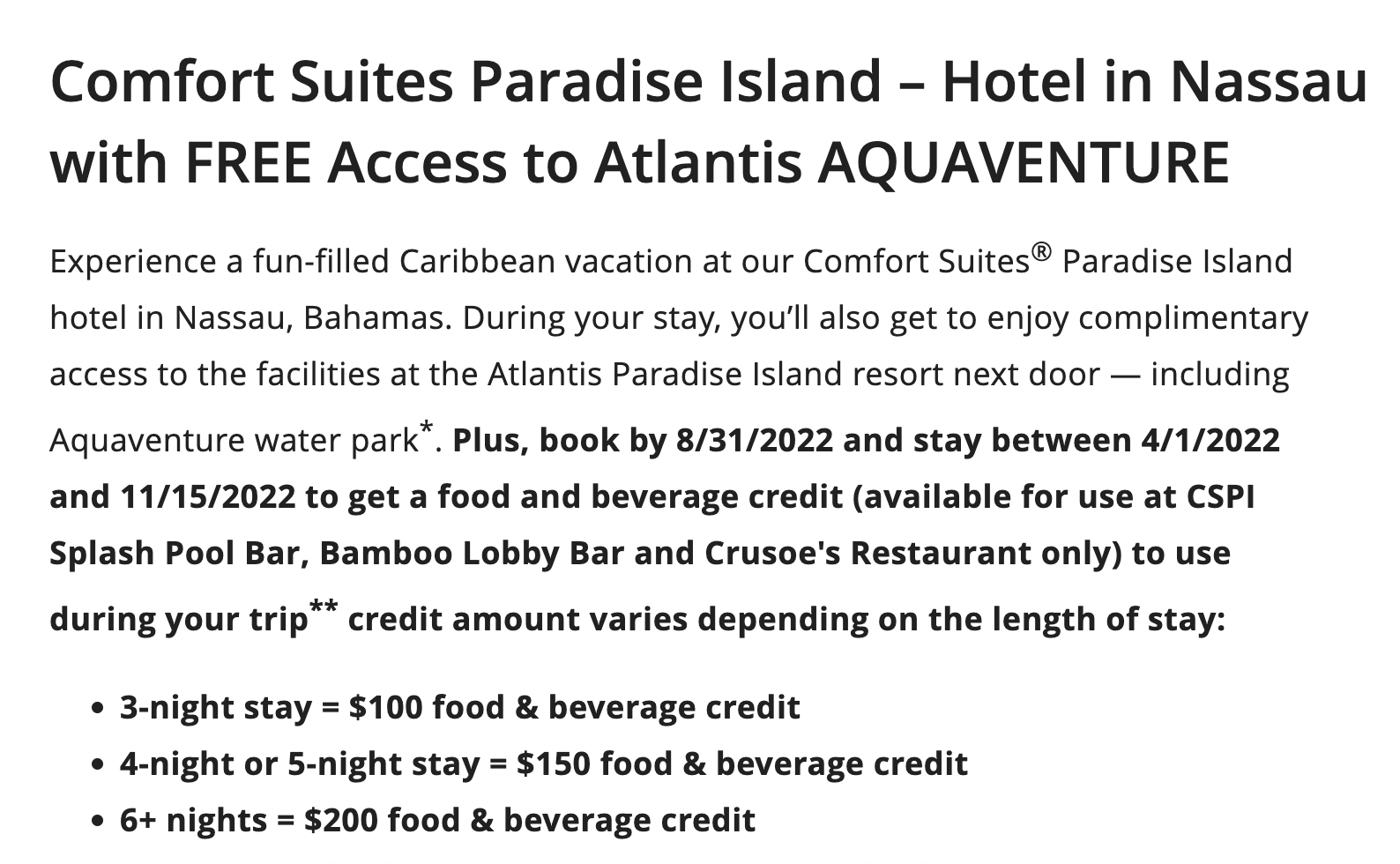

McHenry says Choice Hotels offered her a $150 food and beverage credit through a promotion on its site. That played a significant part in her decision to stay at the Comfort Suites Paradise Island when she visited the Bahamas this summer.

She verified the $150 credit when she checked into the hotel. And then she headed over to Crusoe’s Restaurant for a nice seafood dinner. Her tab: $111.

Before returning to her room, McHenry checked again to make sure she could apply her $150 food and beverage credit to her bill. A server told her she could.

At checkout, McHenry again asked about the food credit. And again, a representative assured her that the $111 would come from the food and beverage credit.

It didn’t.

Her final bill was $111 over — an obvious hotel billing error. The amount showed up as “pending” after she checked out, and it went on her account five days later. (Related: Can this trip be saved? Stuck with a $2,430 bill at the Copacabana Palace Hotel and Spa.)

“I have emailed the hotel at least three times, and they refuse to answer,” she says. “Choice Hotels finally responded to one of my emails stating that they could not assist because the hotel is franchised.” (Related: A traveler can’t explain TV damage at Wyndham Avenue Plaza Resort.)

What hotels will do to keep your money (even if they made a billing error)

Choice Hotels’ response is typical — and it’s maddening. The company says customer service isn’t our problem, even though the hotel has our name.

It’s the hotel’s problem. Take it up with them.

There are several ways hotels can make a billing error and keep your money:

- Refuse to respond (the silent treatment).

- Claim a third party made the mistake (the restaurant is not part of the hotel, so take it up with them).

- Blame it on a franchisee.

Double down on the error (say it was a legitimate charge).

I’ve seen it all. But the worst is when the hotel refuses to communicate with you, which was McHenry’s problem. No matter how hard she tried, the Comfort Suites Paradise Island wouldn’t respond to her — even after representatives had repeatedly assured her that her food and beverage credit was good. (Related: A $2,500 MasterCard billing error! Is the cardholder out of luck?)

What are the most common types of hotel billing errors?

Hotels bill their guests for incorrect amounts constantly. Now more than ever, the attitude is, “When in doubt, add it to the bill.” That results in all kinds of misunderstandings. Here are the most common types of hotel billing errors that we see at Elliott Advocacy:

Wrong rate

Your confirmation said you were getting the room for $120 a night. But your folio says it’s $140. Who’s right? The hotel will insist it is right — which is why you must keep screenshots of your confirmation.

One more night

The hotel charges a guest for an extra night even though that person is long gone. Then they add it to their credit card as a late charge. The evil part of this error is that the guest often doesn’t notice it.

You took the pillow

From minibars to bathrobes, hotel rooms have become mini-malls. Often, the hotel waits until you’ve checked out to assess the bill. The accounting is notoriously inaccurate. Consider that in some minibars, all you have to do is move a drink to get charged for it.

You smoked in the room

This may be the most common hotel billing error. Hotels routinely blame their guests for smoking, even if those guests are nonsmokers. Fighting these hotel billing errors is exceptionally difficult. How do you prove you didn’t smoke in the room?

How do you fight a hotel billing error?

You can fight a hotel billing error and win. Here’s how.

Check your hotel folio very carefully

About half of the billing errors crop up during your stay. That means you can easily spot them if you know what to look for. In many chain hotels, you can pull up a tab of your charges in real time. Even if you can’t do that, at the very least you should carefully review your bill before you check out. Don’t let them slide your invoice under the door and then tuck it away — read it carefully before leaving. Your best opportunity to dispute a billing error is at the hotel.

Keep tabs on what you consume

This may seem a little over the top, but it’s a proven way to avoid an overcharge. Take pictures of your charges. Restaurant bills. Gift shop invoices. Even take a picture of your minibar at checkout. I’ve seen hotels bill twice for the same service, and the problem would have been easily fixed with an image of the pillow or plush toy or the invoice. Remember, your hotel will send someone to your room after you check out. If anything is missing, it goes on your bill.

Not sure of something? Ask now

If you think your hotel might charge you for something, don’t hope for the best. Ask. And when you do, take names. If you’re talking to a manager, get that person’s name. If a server promises you won’t be charged, get that person’s name. It may seem nosy, but you’ll thank me later if you have to file a dispute.

Use my proven strategies for resolving your problem

You know — be patient, persistent and polite. Here are my proven strategies for fixing your problem.

If that doesn’t work, file a credit card dispute

I explain how to do that in my free guide to filing a credit card dispute. (Only do this if the hotel refuses to respond to your polite inquiry.)

My verdict: Her self-advocacy gets an A minus

McHenry’s self-advocacy efforts were outstanding. She checked three times to see if she could use her food and beverage credit, including when she left. She also followed the Elliott method for resolving her complaint. And she kept a thorough paper trail, first contacting the hotel and then Choice Hotels at the corporate level. I’ll give her an A minus for her efforts.

An appeal to one of the executive contacts at Choice Hotels might have done the trick. I list the names, numbers and emails of the Choice Hotels managers on this site.

I love it when consumers like McHenry take the initiative and follow through. She’d make a great consumer advocate. (Related: What should I do about this $50 phone bill?)

Here’s your refund for the $111 restaurant charge

My advocacy team couldn’t believe Choice Hotels’ response at the corporate level. They chose the “blame the franchisee” excuse, which is the wrong thing to do. If you’re part of a hotel chain, there’s a chain of command that goes straight to the top. If the hotel can’t do right by its guests, it could lose its flag. In other words, Choice could withdraw its franchise license.

Our advocate Dwayne Coward reached out to Choice Hotels and showed the property the paper trail between McHenry and the hotel. Here’s how it responded:

On behalf of the entire team here at Comfort Suites Paradise Island, we would like to extend sincere apologies for the inconvenience you experienced during your stay at our hotel.

After a thorough investigation into your concern, it was discovered that your food and beverage charge for $111 was processed directly at our on-property restaurant, which means it would not have been visible on your room folio for reversal.

Please know this is not an excuse on our behalf but an explanation as to why the error occurred.

A full refund of $111 was processed today to your visa card as a gesture of goodwill.

Once again, we sincerely apologize and hope you will consider staying with us again so that we can have another chance to provide you with a superior experience.

McHenry is pleased with that resolution. My team is, too. But it feels more like the right gesture than a gesture of goodwill.