Before Bonnie Solberg booked a South Dakota vacation, she thought a travel insurance policy might be a good idea. It was.

An even better idea: reading the fine print on her travel insurance policy before she bought it.

Solberg’s tragic story is a case study in policies that look great at first glance. But a closer examination of the fine print reveals that they may not protect you when you need them most.

Thanks for the reminder, United Airlines

Solberg and her husband planned to travel from San Francisco to South Dakota last summer. When she booked her airline tickets, United offered her an optional travel insurance policy through Allianz.

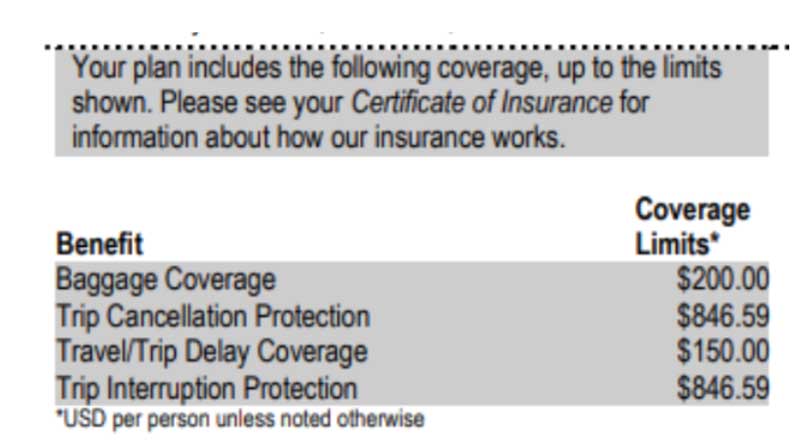

Here are the coverages on the policy she purchased for herself and her husband, Jim.

She says the policy cost $97 per person, which is kind of pricey considering these minimal coverage levels. Allianz says the cost for both travelers was $97.

And then the unthinkable happened.

A tragic end

The couple traveled to the South Dakota ranch where Jim Solberg grew up.

“Jim was injured on the second day we were there,” says Solberg. “He was in a surgical critical care unit for 16 days before we could get him home by air ambulance.”

Solberg’s husband then spent two days in a California hospital. Their total expenses: $28,333.

And then he died.

“I faxed Allianz all of the documentation necessary for reimbursement,” says Solberg. “Allianz said they did not receive the fax. Thereafter I sent everything via certified mail. I did not hear back from them and after finally getting a “real person” on the line, was told to send more documentation, which I did.”

After more months of back and forth, Solberg received a check for $500 — $100 a day for five days.

“An Insult”

Allianz explained that under the terms of her policy, that’s all they were required to do.

“An offer of $100 per day for five days is an insult,” says Solberg. “I would like our expenses to be reimbursed.”

My advocacy team was deeply moved by her story and wanted to help. Advocate Dwayne Coward asked Solberg to send him the paperwork and promised to review it quickly. But when he did, he came to the same depressing conclusion that the Allianz claim adjusters had: The travel insurance company had done everything it was required to do. (Related: Do I deserve a refund after volcanic eruption?)

The policy Solberg purchased did not provide any coverage for medical treatment or medical evacuation, and the maximum limit for trip interruption is $846. That includes reimbursement for any nonrefundable prepaid expenses and up to a “maximum of $100 a day for up to five days” for “the cost of staying longer than you planned.”

Case closed.

Who writes these policies?

Our advocacy team is baffled that these policies can even be called travel insurance. For $97 per person, Solberg and her husband should have received a policy that covered hospitalization and other basic expenses. Our advocate reviewed numerous policies on Insuremytrip.com and Squaremouth.com for travel insurance coverage for two middle-aged travelers from California traveling to Montana this upcoming August. On both sites, he found policies that included the benefits provided by their policy, as well as secondary medical and medical evacuation coverage, for less than what she paid.

United Airlines offered the Solbergs travel insurance but provided them with a junk policy, a shell of what decent insurance typically covers. That’s such an airline thing to do. After all, the airline tickets of today bear virtually no resemblance to the ones you bought a generation ago. In most cases, you can’t make changes, get a seat assignment, a decent meal or check a bag — everything is extra.

I think everyone needs to know about these junk policies being peddled by travel companies. And everyone needs to read the fine print on their travel insurance.

The Solbergs could have found a better Allianz policy through a third-party travel insurance site or by going directly to a travel insurance company. Maybe the lesson learned here is: Never buy travel insurance through an airline.