Jacob Finn made a big mistake when he applied for travel insurance. And now he’s in big trouble. He’s also learned the answer to the question: What happens when you give the wrong information on your insurance application?

Spoiler alert: it’s not good. But in this case, it’s bizarre.

Finn lives in Bar Giora, Israel, and he thought he had car rental insurance while he visited France. It turns out he wasn’t covered, but not for the reasons you would suspect. Finn gave the wrong information on his insurance application, which automatically rendered his policy invalid.

His story is a reminder to provide accurate information when you’re signing up for travel insurance — or any insurance for that matter. But it’s also a tough lesson about travel insurance. If you don’t follow the rules, you could end up with a policy that doesn’t work.

If you don’t live in Alaska, don’t tell your insurance company that you do

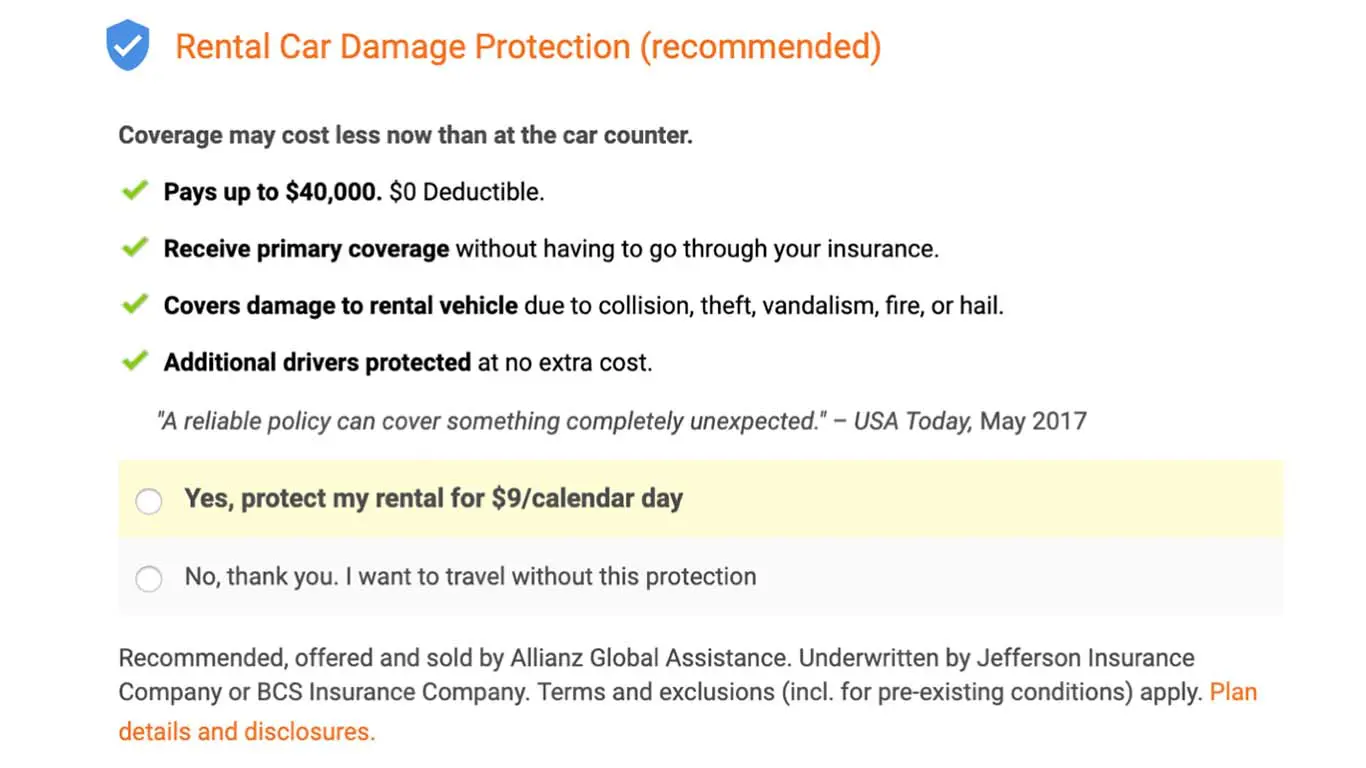

Finn recently rented a car in France through the website Carrentals. The company offers optional insurance through Allianz Global Assistance:

Finn paid the $9 a day for the coverage.

But when he picked up the rental in Bordeaux, France, a representative said the coverage was no good.

“They blocked 13,000 euros on our visa card,” he remembers. “This caused us a problem since we could not use our credit card any further. When we informed Carrentals of the matter, they told us that in fact, the insurance is valid only for U.S. citizens.”

See, Allianz thought Finn lived in Alaska. I told you this was a strange case. Details in just a moment.

Next, Carrentals canceled Finn’s policy.

“We asked them to stop the cancellation. But to our astonishment, we received a cancellation email from Allianz Global. We called Allianz Global to try and solve the issue, but unfortunately they refused to reactivate the policy,” he says.

Finn contacted the Elliott Advocacy team while he was at the counter, asking us to help him reinstate the coverage.

Give the wrong information on your insurance policy, and you’ll have no coverage

Travel insurance has some important restrictions and limits. In short, you must provide accurate information when you’re buying insurance.

Had Finn clicked on the terms and conditions of his insurance, he would have found this disclosure: “Plans are intended for U.S. residents only and may not be available in all jurisdictions.”

Travel insurance is available to anyone regardless of citizenship. You just have to be a U.S. resident.

Is it a crime to provide false information?

Turns out it’s a crime to provide false information to a travel insurance company. In the terms, Finn also would have found numerous — and I mean numerous — fraud disclosures.

I’ll just excerpt a few of them:

Important Fraud Warnings

Alabama, Maryland, New Mexico, Ohio: Any person who knowingly or with intent to defraud an insurer presents a false or fraudulent claim for payment of a loss or knowingly includes false information in an application for insurance, is guilty of a crime and may be subject to criminal penalties and fines.

District of Columbia: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

In other words, there are geographic restrictions on travel insurance and strict penalties for providing false information. Why is this so important to Finn’s case? Because he’d given Allianz wrong information about his residence — a 6,000 mile difference.

Is insurance required when you rent a car in France?

If you rent a car in France, you must carry unlimited third party liability insurance. Because of this, most car rental companies automatically include the price of insurance in their rates. However, Carrentals decided to make insurance an optional add-on purchase. That allowed it to display a lower rate for the vehicle. But ultimately, it created a problem for customers like Finn.

Many countries, including Ireland, Jamaica, and Israel, have strict insurance requirements for car rentals. Quoting a rate that doesn’t include insurance is at best incomplete, and at worst deceptive.

Our friends at Auto Europe conduct extensive research on insurance requirements and publish them on their site. The results are unnecessarily confusing. Car rental companies could automatically insure each vehicle. But charging extra for insurance — putting their customers through a lengthy and expensive damage claim process — is more profitable. (Related: Travel insurance no-nos: 5 things you should never, ever do when you’re filing a claim.)

I’m not kidding about the confusion. I handled a case a few months involving a Dollar rental car in Frankfurt, Germany. And there are many, many more.

If you give the wrong information on your insurance application, you won’t be covered

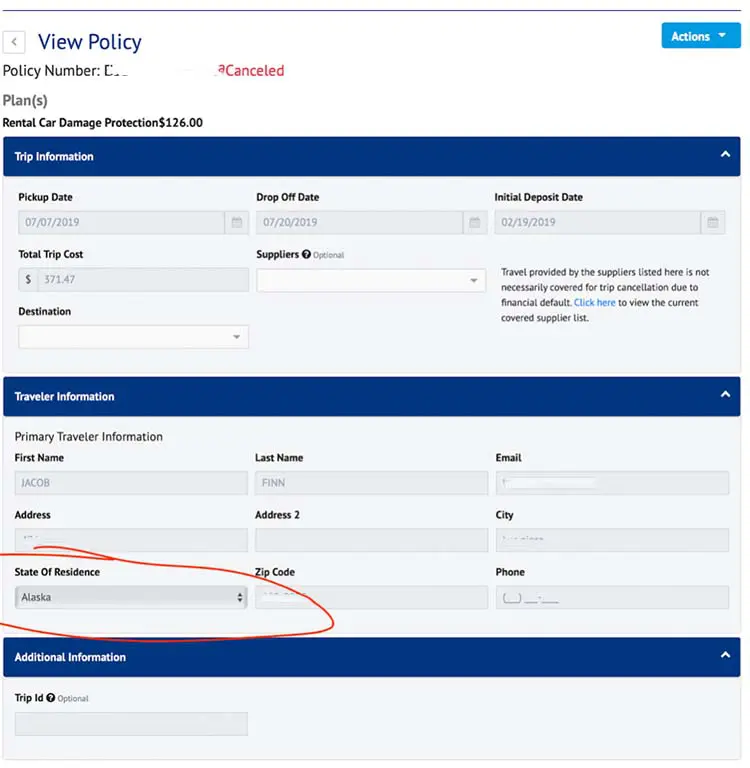

I reviewed Finn’s paper trail between him, Carrentals and Allianz. It was not complete, but that didn’t matter. Just have a look at the screenshot of his insurance purchase.

Wait, doesn’t Finn live in Israel? He does. So why did he put “Alaska” as his state of residence? Because Allianz didn’t offer Israel as an option. He gave the wrong information on his insurance application.

And with good reason. It doesn’t offer insurance to Carrentals customers who live in Israel. My team can’t quite figure out how he ended up on this page, but we speculate he was using a Virtual Private Network (VPN) to complete the booking. A VPN allows you to spoof another location. So Finn could log on from Israel and make a reservation as if he was in the United States.

Finn gave inaccurate information to his travel insurance company. It thought he lived in the United States.

It had every right to cancel his coverage.

If you give the wrong information on your insurance application, this could happen to you

The takeaway is obvious: Never give inaccurate information to your travel insurance company. There’s a reason for all those rules. Fraud costs U.S. insurance companies $40 billion per year, according to the FBI. That translates into between $400 and $700 per year in the form of increased premiums.

It is so easy to commit fraud. I know because the last time I tried to file a claim on our previous health insurance policy, I asked if we could change the “reason for visit.” A nurse told me that would be insurance fraud.

Finn just wanted a rental car in Bordeaux. He didn’t want anyone putting a 13,000 euro hold on his credit card. And I’m pretty sure he didn’t want to be part of a story about insurance fraud. But his situation was avoidable.

Always fill in your insurance application accurately. Don’t take shortcuts. Don’t improvise. And don’t bend any facts.

If you have a question like, “Why isn’t Israel in the pull-down menu?” call the travel insurance company immediately. Don’t assume you know the answer. (Here’s what you need to know about travel insurance.)

If any information changes between the date of your purchase and your arrival, let your travel insurance company know. The company will have to make a change to your policy for it to be effective.

In the end, we couldn’t successfully advocate for Finn. He didn’t have a valid policy. Chances are Allianz couldn’t write a policy for Finn even if it wanted to.