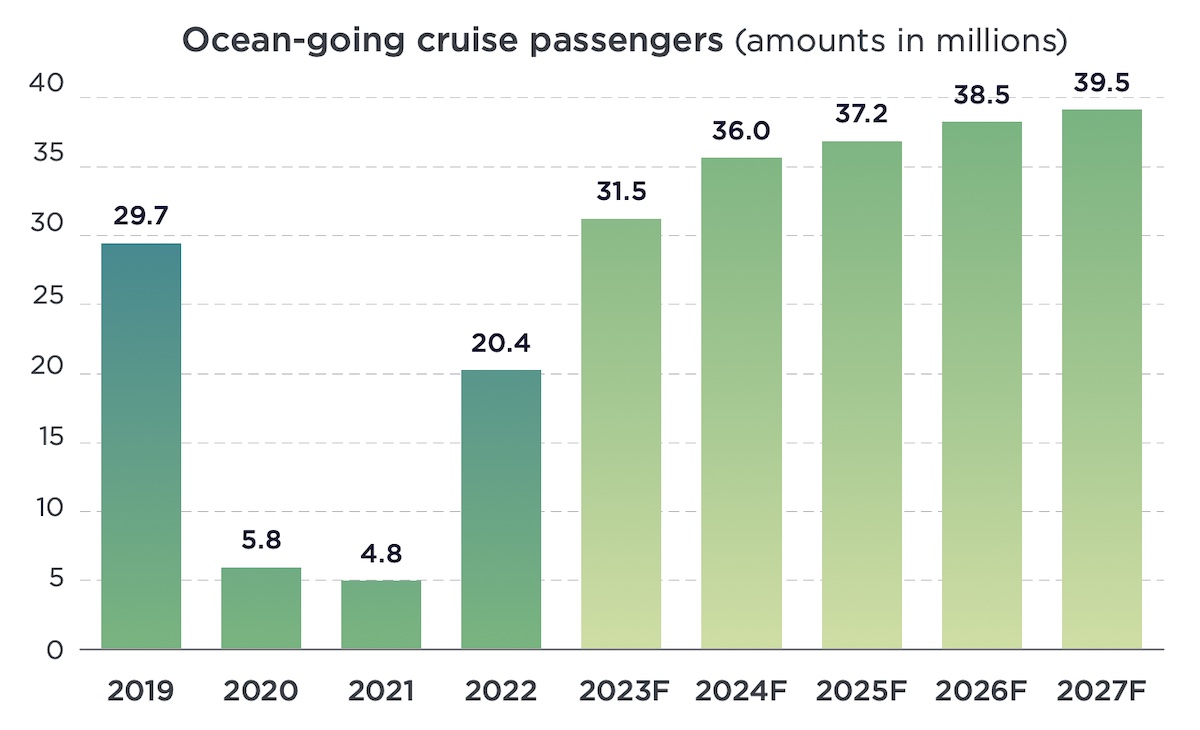

If you’re thinking of taking a cruise in 2024, you’re in good company. It turns out there are a lot of people in the same boat — both literally and figuratively.

It seems everyone wants to cruise in 2024.

That forecast comes to us from the Cruise Lines International Association, a trade group.

But cruise passengers also have a lot of questions about cruising that a trade association can’t answer. They include:

- Is cruising safe now?

- What are my rights, and what should I be worried about?

- If I decide to cruise, what’s the best way to book my vacation?

This free guide to cruising can help.

Is cruising safe?

Cruise lines claim a vacation at sea is safer than any land-based vacation. That’s not entirely true. Here are some of the risks.

Infectious disease

COVID and norovirus outbreaks are common on cruise ships. Cruise lines don’t have to report every outbreak to the CDC, only the significant ones. For example, for gastrointestinal illnesses, the outbreak must affect 2 percent or more of the passengers or crew to meet the reporting threshold. That means cruise lines appear to be less dangerous than they are. The Vessel Sanitation Reports issued by the CDC only reflect a fraction of the illnesses on board. Last year, the CDC reported 13 norovirus outbreaks on cruise ships — the highest number of outbreaks since 2016.

Violent crime

The high seas can be dangerous, and not just in the movies. Robbery, assault and homicide happen on cruise ships. And when they do, they are often underreported. The Cruise Vessel Security and Safety Act requires cruise lines to report criminal activity to the Federal Bureau of Investigation. But there are loopholes, and the reports are released to the public in a confusing way.

Sexual assault

Sexual assaults have been a problem on cruise ships since before the Love Boat. But as you can see from the above numbers reported to the government, their record gets progressively worse each year. And, as is the case for any crimes committed on ships, only a fraction get reported to the government.

Health emergencies

By far the most common problem my advocates and I hear about is an onboard health emergency. Onboard doctors don’t have the equipment or facilities to handle a serious illness. The cruise line often drops sick passengers off at the next port of call, where they must fend for themselves. And in many ports of call, the medical facilities are not up to Western standards, and the patient must pay in cash. Get travel insurance. If you have a severe health problem, avoid cruising.

You’ll need to consider all of these dangers before you plan your cruise. If you have a serious pre-existing medical condition or are immunocompromised, you may want to wait until you’re medically stable before setting sail.

There are many other health perils at sea. Free-flowing booze is at the top of the list. Avoid taking your teenagers on a cruise line with a reputation for partying. (That’s just asking for trouble.) Watch for food-borne illnesses. We receive regular complaints about food poisoning on cruise ships.

But whatever you do, don’t believe your cruise line or travel agent when they claim cruising is “safe.” There’s no form of travel that’s safe right now.

Is COVID still a risk?

Yes, it is. Late last year, a Princess ship cruising off the coast of Australia was hit by a norovirus and a COVID outbreak. Most cruise lines have stopped screening their passengers for COVID. If you test positive, cruise lines will confine you to quarters or to a special section on the cruise ship for infected passengers, usually for the duration of the voyage. We have not had any reports of passengers with COVID being forcibly removed from a in more than a year.

What kind of cruise should I take?

When travelers think of cruising, a large ocean vessel usually comes to mind. But there are lots of cruise options. At a time like now, some may be safer and more convenient than others. Here’s a quick rundown of the choices:

Ocean cruise

This is the classic cruise experience — a large vessel with onboard dining, entertainment and shopping. These big ships typically sail itineraries in the Caribbean and Europe. There are a variety of ocean cruises, from budget to luxury. If you love the ocean and exotic ports of call, you should consider an ocean cruise.

River cruise

If you prefer a smaller ship and don’t like waves, a river cruise might be right for you. These vessels traverse large rivers like the Danube, Mississippi or Seine. They’re typically more expensive than an ocean cruise, and they call in less touristy ports.

Small ship/adventure cruise

Some oceangoing vessels are smaller and more specialized. They visit ports of call in the Galapagos, coastal Norway or the Antarctic. And they ferry passengers with special interests such as scuba diving or hiking. Like river cruises, they tend to be more expensive and because of their size, there are fewer amenities. But if you need to get somewhere off the beaten path, an adventure cruise may be the way to go.

How to book a cruise

Not so long ago, you had to pick up a phone and call your local travel agent to book a cruise. No longer.

Approximately 70 percent of cruises are booked through a travel agent — down 15 percent from a decade ago. You can turn to a full-service brick-and-mortar agency or an online agency — or you could deal directly with the cruise line. But which one is right for you?

The case for a full-service agent

Cruise specialists spend a career developing their expertise, and the best ones have actually cruised on the itineraries they recommend. A human travel agent who can take the time to sit down with you and talk about your cruise options is a tried-and-true way to buy a cruise.

Benefits of an agent

- One-on-one service and attention to detail. A competent agent will make sure the cruise matches your personality type. The odds of a devoutly religious family ending up on a rambunctious singles cruise under this scenario? Virtually zero.

- Special access to agent-only discounts. If the agency is a member of a larger group, like AAA, you’ll get deals no one else has, and they may be unbeatable. (But don’t take your agent’s word for it — trust but verify, as they say.)

- Access to possible upgrades and onboard credits. Again, these offers come by way of the relationships cruise agents have through their company or by being friends with their regional sales representative.

- Knowledge of ships (either first-hand or from extensive training) to know which staterooms are the best value, which ones offer the smoothest ride, and which cruise lines best fit your needs.

Drawbacks of an agent

- If it’s a small shop, you may not have 24/7 support. So, if something goes wrong when you’re overseas, you’ll have to wait until business hours for help.

- Agents are not free. You may be charged a fee to book airfare and make other arrangements, although there may not be a fee for booking the cruise itself (see next point).

- Agents are often incentivized by commissions and bonuses called “overrides” from cruise lines that reward them for booking a lot of itineraries with the same company. (Think of it as a kind of rewards program.) First and foremost, an ethical agent will make sure the cruise is the right one for you, but some agents, sadly, go straight for the highest commission. Travel agents can make 10 percent or more in commissions and overrides from your cruise. I’ve heard of these kickbacks going as high as 14 percent.

The case for an online agent

Today’s travel websites try to combine the best aspects of a full-service agency with the conveniences of modern technology. Often, they succeed.

Benefits of an online agent

- You’re in control. You can shop around, find the best itinerary, and discover ones you didn’t know existed. You can also book the cruise whenever you want to.

- You have 24/7 phone support through most of the online agencies. When something goes wrong, someone should always be there for you.

- Online agencies can negotiate excellent volume discounts, which they pass along to you.

Drawbacks of an online agent

- It’s an online travel agency. Many of their phone agents are located in overseas call centers. They read scripts, are timed by their supervisors, and really don’t care if you’re having a good vacation. No wonder offline agents call these operations “vending machines.” Also, they may try to steer you to the highest-commission cruises by displaying their favorite cruises first.

- Service, when it does come, can be slow and impersonal. It’s not uncommon to hear of people waiting upwards of an hour for help.

- You may feel like a number. That’s because you are a number. You’re one of a million, literally. Online agencies are a volume business, so if you like to feel special and appreciated, you might want to book elsewhere.

The case for a direct booking

Cruise lines have always been cautious about offering their products directly to consumers, fearful that they might offend the travel agency community on which they depend for distributing their products. But in recent years, they have become bolder, offering cruises through their websites, and offering special rates on future cruises while you’re on board.

Benefits of a direct booking

- You’ll probably get the deepest discounts, and in some cases, a price protection that assures you that if the fare drops, you’ll get a refund. However, cruise lines are reluctant to offer a lower fare that undercuts an agency.

- You’re dealing directly with the cruise line, so the company can’t blame an intermediary for anything that goes wrong.

- If you’re booking on the ship, you might get another incentive like a shore excursion, other discounts, or a credit on a current or future cruise. Cruise lines are sometimes creative with their offers.

Drawbacks of a direct booking

- You’re dealing directly with the cruise line. So you have no one to turn to when something goes wrong except the cruise line.

- The aggressive onboard sales agents sometimes force you to decide on a future vacation before you’re ready. It’s a high-pressure sales pitch on the high seas.

How do you buy a cruise, then? In the end, there may be no correct answer for everyone. If, for example, you’re taking your extended family on an anniversary cruise, you’ll probably want to find a cruise specialist with experience dealing with large groups. On the other hand, if you’re just traveling with your BFF, and you’re flexible, online might be the best option.

A few practical tips from a consumer advocate

As someone who has been on numerous cruises and has helped resolve cruise problems in real time, I have a few recommendations:

Hands off my bag

One of the first things your cruise line will try to do is take away your luggage. A porter will deliver it to your room. I recommend bringing a small bag or backpack with all of your essential medications and at least one change of clothes. Why? Because the porters don’t always deliver the luggage to your room. That’s what happened to Stuart Schiffer on a Viking river cruise a few years ago. The porters removed his bag and he never saw it again. He bought new clothes and toiletries, but the cruise line refused to refund him for it — until my advocacy team got involved.

Note: Always use a tracking device like an AirTag or Tile if you give your luggage to the cruise line.

Don’t overspend on your cabin

Your stateroom is a place to sleep. Your travel agent may offer you a spacious cabin with a balcony, or even a suite. But once you get on the ship, you’ll realize it’s a waste of money. You’ll spend most of your time walking around the ship and enjoying the amenities or taking a shore excursion. The cabin is for sleeping. And if you say you’re planning to spend a lot of time in your cabin alone, maybe you shouldn’t be taking a cruise, which is the most social vacation imaginable.

Tip: Avoid a cabin near an elevator or nightclub. That can get a little noisy. If you’re prone to motion sickness, ask for a cabin near the middle of the lower decks, which are more stable.

Skip the cruise line’s shore excursion

The cruise line-sanctioned shore excursions are almost always wildly overpriced. You can find a cheaper private tour through a company like Viator. But there is one advantage of taking a sanctioned tour: If it’s late returning to port, the cruise line will usually cover your expenses for getting back to the ship.

Never, EVER, buy jewelry or art

We’ve received numerous complaints from readers who purchased overpriced jewelry or art on their cruises. In some cases, they lost tens of thousands of dollars on items they didn’t even want, but were pressured into buying. When you’re on vacation, it’s easy to let down your guard and fall for a sales pitch for an original sculpture, diamond ring or timeshare. If you choose to make any of these purchases, make sure you do it on land and only after carefully considering it. Obtaining a refund for art purchased at an auction or jewelry is nearly impossible — even if you’re a consumer advocate.

Always consider travel insurance

You probably need travel insurance for your cruise. Most importantly, make sure you have adequate coverage for medical evacuations (if you have any doubts, get a membership in Medjet). For some types of trips, insurance is optional. But not for cruises. Not a week goes by that my advocates don’t receive a case from someone who didn’t have enough travel insurance and faced a large bill at the end of a cruise. Don’t let that happen to you.

Tip: Buy travel insurance through your travel advisor or directly with a travel insurance company, but not through the cruise line. If the cruise line is self-insured and it goes out of business, you could lose everything.

What are my rights as a cruise passenger?

Your rights at sea are governed by maritime law, or the law of the sea. While some U.S. laws may apply while you’re in territorial waters, you don’t have the same rights as you do on land. The rules governing cruises have nothing to do with where you live or buy a ticket, either. Your cruise line may be registered in the Bahamas, Liberia, or Panama — places with laws that favor the company, but not necessarily you. Your ticket contract, the legal contract between you and the cruise line, spells out your rights. You should read it before you leave. Here are some key provisions:

Don’t hold us to the brochure

The ship may or may not keep the promised schedule. For example, Royal Caribbean says it may, “for any reason at any time and without prior notice, cancel, advance, postpone or deviate from any scheduled sailing, port of call, destination, lodging or any activity on or off the vessel, or substitute another vessel or port of call, destination, lodging or activity.” If it does, it owes you nothing for the inconvenience. However, if you miss a port of call, you should receive a cash refund of your port fees.

Note: We received many requests for a refund after canceling Holy Land cruises in late 2023. Unfortunately, insurance does not cover these cancellations and the ticket contract allows them to change their itinerary at any time and for any reason. Bottom line: Don’t book a cruise to a dangerous part of the world unless you are prepared to live with a possible detour.

The quack who treated you isn’t our problem

Most medical care on cruise ships is adequate. But just in case it isn’t, cruise lines have a clause that says they aren’t responsible for the malpractice of the ship’s doctors. Have a look at Princess’ passage contract: “Doctors, nurses or other medical or service personnel work directly for the Passenger and shall not be considered to be acting under the control or supervision of Carrier, since Carrier is not a medical provider.” In other words, when a doctor’s negligence leads to the death of a family member, the cruise line is off the hook.

Time is short

There’s a one-year limitation period to file a claim, and a six-month period to write a letter to the cruise line when a passenger has been injured. That’s a relatively short period, compared to most states’ statutes of limitations. What if you miss your deadline? You’re out of luck.

What’s the international cruise line passenger bill of rights?

After a series of high-profile customer service incidents in 2012 and 2013, the cruise industry adopted a voluntary “bill of rights” for its passengers, to clearly communicate to them their rights regarding comfort and care in a number of important areas. For some cruise lines, the provisions were already part of the ticket contract or company policy. But it was the industry’s way of saying it could do better.

Here’s the bill in its entirety

The Members of the Cruise Lines International Association are dedicated to the comfort and care of all passengers on oceangoing cruises throughout the world. To fulfill this commitment, our Members have agreed to adopt the following set of passenger rights:

- The right to disembark a docked ship if essential provisions such as food, water, restroom facilities and access to medical care cannot adequately be provided onboard, subject only to the Master’s concern for passenger safety and security and customs and immigration requirements of the port.

- The right to a full refund for a trip that is canceled due to mechanical failures, or a partial refund for voyages that are terminated early due to those failures.

- The right to have available, on board ships operating beyond rivers or coastal waters, full-time, professional emergency medical attention, as needed until shoreside medical care becomes available.

- The right to timely information updates as to any adjustments in the itinerary of the ship in the event of a mechanical failure or emergency, as well as timely updates of the status of efforts to address mechanical failures. (Here’s how to get a refund or credit when your itinerary changes.)

- The right to a ship crew that is properly trained in emergency and evacuation procedures.

- The right to an emergency power source in the case of a main generator failure.

- The right to transportation to the ship’s scheduled port of disembarkation, or the passenger’s home city, in the event a cruise is terminated early due to mechanical failures.

- The right to lodging if disembarkation and an overnight stay in an unscheduled port are required when a cruise is terminated early due to mechanical failures.

- The right to have included on each cruise line’s website a toll-free phone line that can be used for questions or information concerning any aspect of shipboard operations.

- The right to have this Cruise Line Passenger Bill of Rights published on each line’s website.

If you’re at sea and you encounter a problem, you may want to invoke your “bill of rights.”

If my cruise is canceled, am I entitled to a refund?

The pandemic exposed one of the most absurd aspects of cruising. You could pay tens of thousands of dollars to a cruise line. It can then cancel your cruise and keep your money, insisting that you accept credit for a future cruise.

In early 2022, the Federal Maritime Commission fixed that loophole. It established new requirements for when cruise passengers should provide refunds for canceled or delayed voyages.

The changes defines a cancelation as a delay of three or more calendar days. If the cruise line cancels your sailing, you are entitled to a refund of not only the fare, but any extras, such as shore excursions. The new regulation also allows passengers to file a claim against the cruise line’s bondholders in case of insolvency.

Common cruise problems

The missed cruise

This is a common problem at my consumer advocacy organization. A delayed flight leads to a delayed connection. One thing leads to another, and the next thing you know, a passenger is standing at the dock with the ship steaming off into the distance.

Don’t let this be you. Always arrive the day before your cruise. Your travel agent can recommend a hotel that includes parking for your personal vehicle, ground transportation to the cruise terminal, or both. Plan to arrive a minimum of 24 hours before your cruise leaves.

Invalid ID, passport or visa

Passengers sometimes arrive at the cruise terminal with the wrong visa or an expired passport. I’ll make it simple. It’s your responsibility — yours alone — to have the correct documents. If you leave the country, you must have a passport. And it should have at least six months’ validity left on it to be safe. If you think you’ll have less, get it renewed before your cruise.

Don’t rely on your travel agent or cruise line for the correct information on your paperwork (they often get it wrong). Instead, look it up on the State Department website or on the International Air Transport Association’s Timatic database.

Forced quarantine

During the pandemic, many cruise lines instituted strict quarantine procedures — some would say, too strict. Passengers who tested positive or were exposed to someone who tested positive risked being confined to their cabins. They complained of being treated like second-class passengers. Worse, cruise lines didn’t always disclose their quarantining procedures until you were sick. So you couldn’t review the quarantining protocols before making a booking decision and say, “No, that’s too much.” The only way to avoid an unpleasant quarantine is to wait until the infection risk is low. Tip: Avoid virus season (usually late winter and early spring).

Missed port of call

Your ship may or may not keep the promised schedule. It doesn’t have to. Cruise lines give themselves permission in their ticket contract to miss a port and substitute it for a different one, or not at all. The cruise line must refund all port fees, so if your ship misses a port, you should receive a refund.

Seasickness

If you get seasick in a bathtub, please don’t book a cruise. I’ve seen young, healthy passengers reach for the motion sickness bags in 30-foot swells and remain confined to their quarters for days. Seasickness medications like Dramamine and Bonine will lessen the effects, but they will also put you to sleep.

Cruise ship “gotchas” they won’t tell you about

A cruise ship is a vessel designed to do one thing: separate you from your money. Whether it’s an optional shore excursion or an onboard auction, the cruise line wants more of your money than you spent on the cruise fare. Here’s how it helps itself to your hard-earned cash:

Everything is extra

The gotchas start the moment you board the vessel. Want a “welcome” drink? It’s extra. Want to take the kids out to dinner or to the arcade? Cruise lines don’t include premium restaurants in your fare. Same thing goes for spa treatments, most shore excursions, and alcoholic beverages. Pictures of the kids by the pro photographers? It’s gonna cost you. The worst fee I’ve seen is for the end cut of a roast served at dinner. Come on! (Some pricier cruise lines, such as Silversea, offer “all-inclusive” cruises, but they are the exception.)

Mandatory tips

Cruise lines add tips of up to 20 percent to your spa or bar bill. (How generous of you!) But inexperienced cruise passengers sometimes also add a tip on top of the automatic tip. What’s more, it’s not always entirely clear who gets the tip. Do they distribute it among the staff? Is it just your server? How much of a cut does the cruise line take? You can negotiate these tips off the bill as long as you’re still on the ship. Once you disembark, the cruise line keeps the money.

Phone calls

A few years ago, cruise lines began installing advanced roaming networks that allowed passengers to make phone calls from the ship. Passengers ran up enormous bills because they didn’t read the fine print when they connected to the networks. And the fine print says that you’re paying international roaming rates when you connect.

Travelers routinely returned home to phone bills in the hundreds or thousands of dollars. Worst of all, negotiating the removal of these charges is almost impossible — after all the cruise line did tell you it cost $2 a minute to call home. The fix: Turn off your cell phone or set it to “airplane” mode. You’re on vacation. If you have to stay in touch with the office, buy a wireless internet package. But stay off the phone.

There’s only one way to ensure you don’t get caught by these fees. Learn the word “no,” and use it often. Want a picture of you and your beautiful family? No. Care for a soda? Uh-uh. Lunch in one of our specialty restaurants? No, no, no. It isn’t that these items aren’t fun to have while you’re on a cruise, but that in many cases, they’re ridiculously overpriced.

How to complain about your cruise

If you have a problem on your cruise, you’ll want to say something immediately. Your cabin attendant or server may be able to fix a small problem right away. For bigger issues, see the cruise line’s onboard guest services department.

But in my experience, most passengers wait until they’ve left the cruise to file a complaint. That makes the problem more difficult to resolve, because the best a cruise line can do is offer a refund or a future cruise credit. And cruise lines don’t like to do that.

Most complaints fall into one of these categories:

Laundry lists

A missed port. Bad service. Tasteless food. It’s not just one problem, but many. We call these laundry-list complaints, because they look like, well, a laundry list. They also don’t work. Why? It’s generally a lot of smaller grievances that don’t add up to much. I advise focusing on a bigger problem and letting the smaller things go.

Paperwork problems

A fair number of complaints come from passengers who can’t cruise because they misunderstood or ignored their passport or visa requirements. The cruise line won’t let them board the ship. We receive many requests for help from foreign nationals with residency permits. Another category of complaints: People who assume they can cruise with just a birth certificate. Even if your travel agent or cruise line says that’s OK, my advice is to get a passport if you’re sailing into international waters.

Refunds and future cruise credits

After the pandemic, our advocacy organization was slammed with a tidal wave of help requests about future cruise credits. Here’s what happened: Many cruise lines offered either a refund or a 125 percent cruise credit when COVID-19 hit. And most passengers accepted the credit. But then the cruise lines canceled their rebooked cruises. When the customers asked for a refund, the cruise lines said they couldn’t get one — future cruise credits were nonrefundable. Other passengers couldn’t cruise for health reasons.

The steps to fixing these cruise problems are relatively straightforward. Here are my strategies for advocating your case. You can also appeal your case to a company executive. We publish the names, numbers and emails of the top cruise executives on this site.

I also have a guide on the most common cruise mistakes as well as how to find your lost luggage. You’ll want to read that before you book your next cruise.

Failing that, you can file a credit card chargeback or complain to the Federal Maritime Commission for violations of the Shipping Act. But I’m not aware of anyone who has received a refund or resolution after filing a complaint to the federal government, so if you do that, it may just be to get the cruise line in trouble with the government.

Smooth sailing ahead?

So should you take a cruise this year? If, after reading this authoritative guide on cruising, you feel that you’re ready, then go for it. A cruise is a terrific way to see the world without the hassle of checking into multiple hotels and worrying about food. (It’s all taken care of.) But there are risks now, and perhaps more risks than ever.

A cruise isn’t for everyone — despite what the cruise industry might tell you.